MBA Advocacy Update Mar. 8 2021

On Wednesday, the Consumer Financial Protection Bureau issued a notice of proposed rulemaking to delay mandatory compliance date of the General QM final rule. On Monday, the Federal Housing Finance Agency authorized Fannie Mae and Freddie Mac to release $1.09 billion in affordable housing allocations, more than double last year’s disbursement. And the Senate moved into floor debate and toward likely passage of its version of the COVID-19-related American Rescue Plan (H.R. 1319).

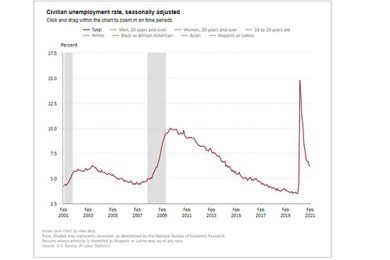

February Sees Strong 379K Job Gain

Employers added an impressive 379,000 jobs last month, the Bureau of Labor Statistics reported Friday, welcome news for an economy still struggling with the loss of millions of jobs resulting from the coronavirus pandemic.

MBA: Customers Best Served By ‘Robust, Competitive Market’

So, you might have noticed some interesting recent developments in the mortgage broker world.

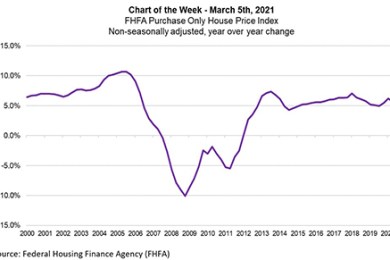

MBA Chart of the Week Mar. 5 2021: FHFA Purchase-Only Index

The rate of U.S. home-price appreciation continues to be driven higher by a combination of strong demand for housing and record-low housing inventory for sale. The Federal Housing Finance Agency's most recent release showed the fourth quarter saw annual home-price growth of 10.9 percent –the strongest annual change on record. The previous high was an increase of 10.7 percent in third quarter 2005.

The Week Ahead—Mar. 8, 2021

The Mortgage Bankers Association has a busy week. MBA releases its weekly Forbearance and Call Volume Survey today (Mar. 8) at 4:00 p.m. ET.; On Tuesday, Mar. 9, MBA releases its monthly Mortgage Credit Availability Index. And on Wed. Mar. 10, MBA releases its Weekly Applications Survey.