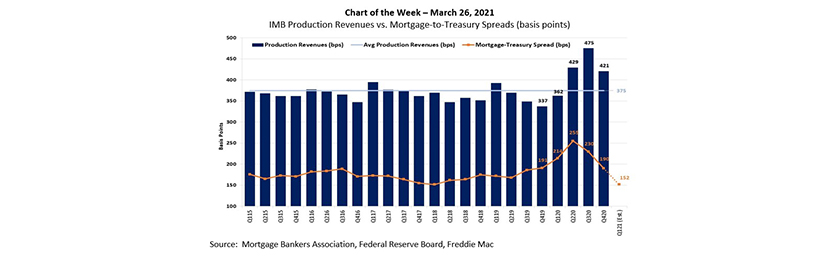

MBA Chart of the Week Mar. 26, 2021: IMB Production Revenues

MBA released its latest Quarterly Performance Report for the fourth quarter last week. The total sample of 366 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 137 basis points (or $3,738) on each loan they originated, declining from a record-high 203 basis points in the third quarter.

Production revenue, rather than reduced production expenses resulting from the higher volume, was the primary driver of stellar production profits in 2020. While production profits were still incredibly strong in the fourth quarter, there was an overall drop in this production revenue as secondary marketing gains declined and production expenses also grew – despite higher volume.

In this Chart of the Week, we compare in basis points the average quarterly credit spreads between the 30‐year mortgage rate (as surveyed by Freddie Mac) and the 10‐year Treasury yield to production revenues (fee income, secondary marketing income and warehouse spread). Between fourth quarter 2019 and second quarter 2020, credit spreads widened by nearly 65 basis points and remained above historical levels through the third quarter. Meanwhile, production revenues increased by nearly140 basis points between fourth quarter 2019 and third quarter 2020 and peaked at 475 basis points, which was 100 basis points higher than the five-year historical average.

In fourth quarter 2020, there was a decline in both the Mortgage-Treasury spread and production revenues from the previous quarter. Among the factors contributing to this decline: rising mortgage rates that add pricing pressures to meet volume targets, dissipating industry capacity constraints and changes in the mortgage risk outlook. As we see higher rates, rapidly declining refinance activity and narrowing spreads in first quarter 2021, production revenues may decline further, putting pressure on mortgage companies to make expense reductions or accept a return to lower quarterly production profits – since inception of MBA’s Quarterly Performance Report in 2008, production profits have averaged 53 basis points.

– Marina Walsh mwalsh@mba.org; Jenny Masoud jmasoud@mba.org; Joel Kan jkan@mba.org;