MBA Advocacy Update Mar. 22, 2021

On Monday, HUD finalized updated forms in the FHA Single-Family Condo approval process. On Tuesday, the Senate Banking, Housing, and Urban Affairs Committee held the first of what is expected to be a series of oversight hearings on housing policy this year. And on Thursday, MBA submitted feedback to FHA in response to ML 2021-05, which extends the foreclosure and eviction moratorium and expands the use of FHA’s COVID-19 Loss Mitigation options.

KBRA: Review Those Remittance Reports

Kroll Bond Rating Agency, New York, said higher commercial mortgage-backed securities special servicing volume and modifications increase the risk of operational errors or inconsistencies in servicer and trustee reporting.

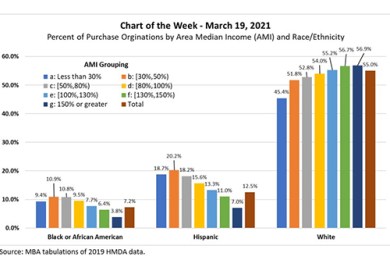

MBA Chart of the Week: Percent of Originations by Median Income, Race/Ethnicity

We analyzed the 2019 Home Mortgage Disclosure Act data for the 30 largest metropolitan statistical areas to understand the distributions of first lien mortgage purchase originations by Area Median Income and by race/ethnicity.

MBA RIHA Study: Affordability Growing Challenge for Low-, Moderate-Income Renters in Majority of Top 50 Metro Areas

Home prices and rent appreciation have exceeded income growth since the turn of the 21st century. This has created economic obstacles for many American households, especially for low- and moderate-income renters living in cities with recent employment growth but significant housing supply constraints, according to a new report from the MBA Research Institute for Housing America.