Redfin: Relief from Red-Hot Market May Be on Way

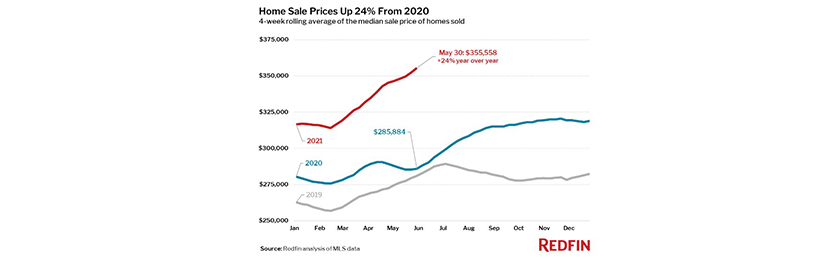

(Graphic courtesy of Redfin.)

Redfin, Seattle, said asking prices leveled off as pending sales–which were rising at this time in 2019–posted a 3% monthly decline. Homes still sold for record prices, at record speeds.

“The housing market’s temperature may be starting to drop by a degree or two, Redfin said. Both pending sales and asking prices began to decline or flatten in the four weeks ending May 30.

Redfin Chief Economist Daryl Fairweather said it’s too soon to tell if these are early seasonal changes or the start of a post-pandemic cooldown. The period in question includes the beginning of Memorial Day weekend.

“The housing market was going 100 miles per hour and now it’s down to 80,” Fairweather said. “This is not the bursting of a bubble. Rather, it’s a sign that consumers might rather spend their time and money on other things besides housing now that travel, dining and entertainment are resuming in full force.”

Other report findings:

–Pending home sales fell 3% from the four-week period ending May 2, compared to a 2% increase over the same period in 2019. Compared to 2020, they are up 38%.

–Asking prices fell $2,500 from the four-week period ending May 23 to a median of $354,975, up 11% from the same period in 2020.

–New listings of homes for sale were down 8% from the same period in 2019, and are down 5% from the 2021 high, which was set during the four-week period ending May 2. During the same period in 2019, new listings fell 2%.

–Active listings (the number of homes listed for sale at any point during the period) fell 37% from the same period in 2020.

–For the week ending May 28, mortgage purchase applications decreased 3% week over week (seasonally adjusted). For the week ending June 3, 30-year mortgage rates rose slightly to 2.99%.

Still, Redfin said, measures of home sales that closed during the four weeks ending May 30 set new records for the housing market heat wave:

–A record-high median home sale price of $355,558, up a record 24% year over year.

–A record high of 52% of homes sold for more than their list price, up from 26% the same period a year earlier.

–A record-high 102.0% average sale-to-list price ratio, which measures how close homes are selling to their asking prices. This means that the average home sold for 2.0% more than its asking price. A year ago, it sold for 1.5% below asking.

–A record low of 16 days on market for homes that sold during the period, down from 37 days from the same period in 2020.

The share of homes sold in one or two weeks were both just shy of their record high and have been relatively flat since the four-week period ending March 28. Nearly 57 percent of homes that went under contract had an accepted offer within the first two weeks on the market, just below the 57.1% record set during the four-week period ending March 28. And 43.5% of homes that went under contract had an accepted offer within one week of hitting the market, down from the 43.9% record set during the four-week period ending May 9.