BREAKING NEWS

Loans in Forbearance Fall for 14th Straight Week

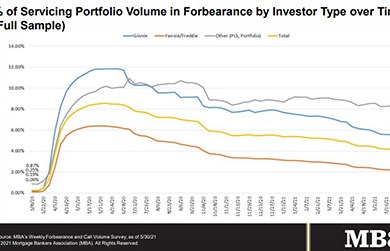

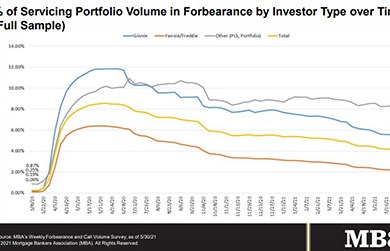

The share of loans in forbearance haven't moved much lately--but for the past 14 weeks, they've been moving down, the Mortgage Bankers said Monday.

The Mortgage Bankers Association and a half-dozen industry trade groups asked federal regulatory agencies to hold implementation of new credit risk retention guidelines until the Consumer Financial Protection Bureau implements its updated Qualified Mortgage general definition.

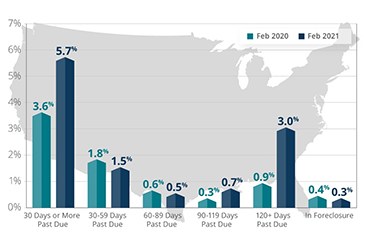

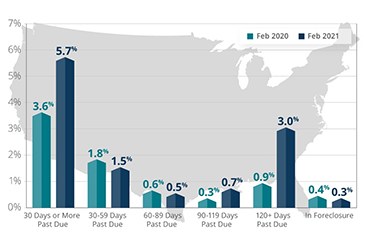

CoreLogic, Irvine, Calif., said just 4.9 percent of all mortgages in the U.S. were in some stage of delinquency, the lowest rate in more than a year.

MBA Research recently wrapped up its annual Servicing Operations Study, a deep dive analysis of servicing costs, productivity, portfolio activity and operational metrics for in-house servicers. In this week’s chart, we show 2020 direct servicing costs allocated by functional area.

Redfin, Seattle, said asking prices leveled off as pending sales--which were rising at this time in 2019--posted a 3% monthly decline. Homes still sold for record prices, at record speeds.

Institutional Property Advisors, Calabasas, Calif., closed retail and multifamily transactions totaling $68.4 million.

Lisa Springer is a senior partner and CEO of STRATMOR Group, Greenwood Village, Colo., a data-driven mortgage advisory firm. She provides direction and leadership to achieve the firm’s strategic goals.

SimpleNexus, Lehi, Utah, named Cathleen Schreiner Gates CEO and announced Founder Matt Hansen will lead a task force of software developers and sales staff that specializes in high-priority projects.

For all intents and purposes, RON has truly been a global solution, and given the renewed effort at the federal level for nationwide RON authorization, the shift may happen sooner rather than later for any remaining nay-sayers.

In this article, we will analyze the bottlenecks due to a manual & paper intensive process that lead to loan defects. Based on this understanding, we will investigate the key business risks from such loan defects and how automation can play a role in mitigating these risks.

As banking, mortgage and financial services look to remain innovatively different, the quest to “do something” that leverages their people, processes and partners is creating a dystopia during a period of profitability for many leaders unfamiliar with rapid innovations taking place across their markets and offerings.

Last Friday, President Biden’s full fiscal year 2022 budget proposal was released, along with the Treasury Department’s “Green Book” itemizing the revenue implications of various tax proposals.