Mark P. Dangelo: aaS, the Building Blocks for an Uncertain Future, Part 3

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The rapid expansion of as a Service (aaS) solutions coupled with their building block mentality has not only delivered a new IT reality, but it has also launched thousands of firms designed to compartmentalize functionality for banking, mortgage, and financial services (BMFS) organizations. Why is this of importance? Progressive and established leadership teams are now recognizing that aaS is reducing barriers to entry, creating rapid-cycle innovation and delivering on the promise of “open” banking (i.e., BaaS, banking as a service). aaS offerings also delivers on one critical operational BMFS reality—agility.

Moreover, factor in the headlines of “80% of tech could be built outside of IT by 2024, thanks to low-code tools” and demand of aaS now valued at over $400 billion will rise as it has only achieved a 35% market penetration. With large IT departments relegated to the traditional, and with divisional business heads and small and medium firms seeking capital-minimal innovation offerings, the use of aaS is estimated to reach $1 trillion by 2026. For BMFS leaders, the expansive capabilities, and layers of aaS is forcing a comprehensive reexamination of innovation and technology priorities including the provisioning of traditional systems such as LOS’s, loan and securitization due diligence and customer contact and experiences.

The great unknown with aaS and its expansion resides with housing and finance industry facing inflationary and interest rate pressures till at least the end of 2022—and confirmed by a growing number of Fed officials. Feeding into these pressures are supply chains that need comprehensive review and restructuring, which includes the streamlining and use of straight-through processing (STP) for BFMS including incorporation of smart contracts, blockchain, and CBDC’s (central bank digital currencies). And, with the low supply of homes for sale and their substantial median price increases, there are now more real estate agents than dwellings on the market.

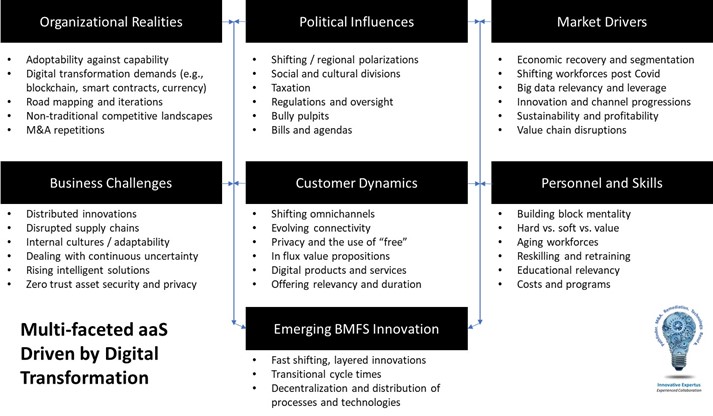

aaS for many of these innovational demands advancements now seems to be the preferred provisioning process to eliminate long lead times, ensure market alignments and reduce capital expenditures, while delivering the agility needed for fast-cycle markets and changing consumer behaviors (see detailed, illustrative issues below).

aaS is Now Centered on Agility and Alignment

Agile (within the aaS world) is a word highly revered in business and professional circles. It also has become common practice for BMFS leadership and leading-edge innovations to add the word “agile” or agility to describe their offerings, to create differentiation and even produce perceived market elitism. From agile development to agile leadership to agile planning to agile project management, and most recently to agile artificial intelligence, the list of agile concatenated onto a traditional offering somehow makes it better—like chocolate syrup on an ice cream sundae.

Yet is this what agile is when utilizing aaS as a digital transformative tool?

- Is it a means to achieve business model to operational alignment against organizational capabilities?

- Does aaS agility represent a “state of mind” or “emotional quotient” that can be taught or achieved through study?

- Does agility represent a marketing slogan for a commoditized productor service?

- Are you agile or in alignment when your superior says so, or the markets reward you with a higher share price?

- Or is aaS singularly about being organizationally adaptable (e.g., quicker, faster, cheaper or think, build, run)?

Indeed, the answer to these and many other questions is both “yes” and “no.” The vacillation is caused by your perception and expectations of what agility means to you across the aaS implementations.

How does it impact your industry? Does it transform your operations and the innovational solutions targeting customer “pains” and “gains?” Do we (the organization and individuals) have the maturity and culture to thrive in an “aaS agile environment”—or will we crash because we are unprepared for the unfamiliar practices and reward structures (e.g., allowed to fail)?

On the heels of these new work and economic realities, social shifts that were anticipated are now in full swing. And in a post-Covid world where structural, inequitable designs are now transparent, a new external factor is altering the “who, what, why, where, and how” of aaS agility leadership. Moreover, new pressures including a rise in stakeholder capitalism or as some have said, stakeholder accountability is changing the product performance quotients due to unanticipated consumer behaviors.

This is the world of facing aaS agility moving forward. Rapidly aging populations in the developed world. Data captured every two years (compounded) that exceed all the recorded history and repeated every two years and repeated (over again) all to control the selections and decisions of customers. Technology adoption that used to be measured in years now is designed, developed, implemented and iterated in weeks and months often compartmentalized like a child’s building blocks.

aaS represents a building block mentality that is part of the innovation progression for BMFS leaders leveraging advancements not just within their siloed and internally focused operations, but with cross-industry adoption and adaptation of offerings that are embraced by the consumer, ensure trust and verification and leverage information already present within the vast digital ecosystems of business.

The Rise of Non-IT Professionals

As noted in the prior two articles, with the rise of all things digital and the specialization of skills involved, layering of discrete aaS solutions will become commonplace. Using a leadership and delivery method of orchestration, IT departments will become facilitators of information compared to their traditional of definition, provisioning and maintenance.

From blockchains to smart contracts to straight-through processing to customer trust to regulatory compliance, IT personnel will be responsible for the orchestrated use of innovation building blocks, which allow for rapid response as well as end-of-life disposal. The months and years of converting to a new internal system consuming vast resources will be replaced by weeks and months using assembled, iterative, container based aaS building blocks.

Gartner recently projected by 2024, over 80% of technology products and services will be created by individuals and departments that are outside of IT—non-IT professionals. There are other projections that extend this prediction that by 2030 those expensive, recent college exiting data scientists now receiving six-figure salaries and bonuses will be antiquated with no-code and low-code user tools and capabilities. Bottom line, it seems that the exclusive club once belonging to those firms with large IT budgets will be mitigated by the very technologies that made them innovation standouts.

This traditional barrier of coding, data governance, and leverage are early indicators of the impacts forthcoming for machine learning (ML) and artificial intelligence (AI) end-user options. Coupled with advancing sovereign cybercurrencies, and the potential to disintermediate and comprehensively remake the BMFS verticals, these advancements represent a quantum shift of influencers and non-traditional competition.

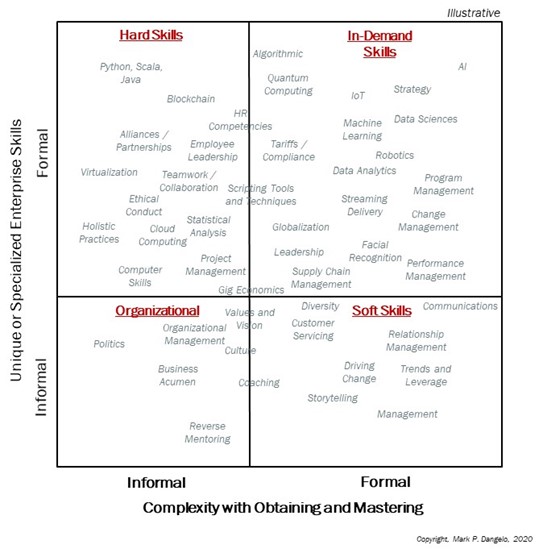

The rise of the non-traditional professional will also put a strain on hiring processes and the algorithms used to screen and vet potential workers. Many of these personnel processes are rooted in Industry 3.0 mindsets failing to consider the current and future need for soft skills, which are often more leverageable than hard skills (e.g., python). The complexity of this task and the shift to non-IT hard skills within an aaS framework underscores the multifaceted challenges now facing BMFS leaders in their quest to stay relevant with their consumer bases. The following illustrative diagram demonstrates the need for change when dealing with unfamiliar aaS layers, assembly and relevancy.

As we reach the end of this series on aaS, the options presented to visionary and innovative leadership within existing BMFS and non-competitors seeking to enter the markets are rising non-linearly. This translates into options and rapid-cycling which is foreign to the BMFS organizational cultures accustomed to retaining customers for years as they lock-in their financial options and limit their movement. The demise of the “contact banker” is expanding. The traditional consumer lock-in represents a key driver on why the disintermediation of the traditional BMFS markets will accelerate as financial dissatisfaction with tradition expands within Gen-Y and Z demographics.

In the end, aaS as a critical part of a building block mentality for BMFS innovation now represents three key elements: 1) reducing costs commonly associated with traditional longtail IT and vendor provision processes consuming 80% of IT budgets, 2) improve the speed to markets ensuring that innovation can be incorporated to meet and exceed consumer expectations and experiential demands, and 3) as a competitive advantage to deliver customer driven solutions while providing the iterative capabilities for adaptable innovational solutions.

aaS is a product offering. aaS is a component of architecture. aaS is adaptable. aaS is a mindset. aaS is an innovational solution component that will help level the competitive landscape from large to small BMFS operations. aaS is a tool—not a panacea. aaS is becoming part of all innovative business model deliveries. aaS’s business value must be understood and implemented as part of the holistic solutions to address customer pains and gains. aaS in the end for BMFS leaders begins the engineering mantra of with “crawl, walk and run.”

aaS will be a critical digital transformation means to stem the average loss of 240 FDIC institutions every year—year after year for well over two decades. Where will you utilize these building block solutions and how will they be measured against performance criteria?

aaS is about asking different questions and implementing iterative, building block solutions—not measuring it against the Industry 3.0 IT benchmarks and serialized processes. If we continue to ask the same questions against an Industry 4.0 consumer and competitive landscape, the answers may seem valid—but the action will have little return. With aaS, we must ask different questions and face the unfamiliar—or become a brand lost to time.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)