ANNOUNCEMENT

MBA Offices will be closed this Monday, July 5, in observation of the Independence Day holiday. MBA NewsLink will not publish; the weekly MBA Forbearance and Call Volume Survey will be released on Tuesday July 6. On behalf of MBA officers and staff, have a safe and happy holiday.

Pending home sales rose strongly to the highest reading for May since 2005, the National Association of Realtors reported Wednesday.

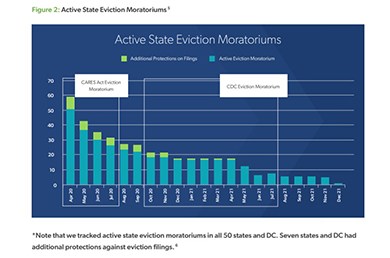

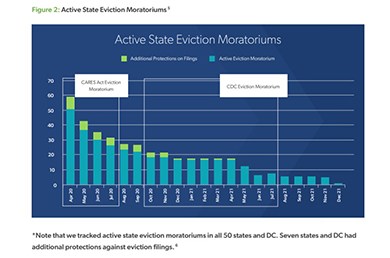

Freddie Mac, McLean Va., said federal and local moratoria in response to the COVID-19 pandemic largely prevented an eviction crisis involving property renters—but the amount of back rent still owed is a “concerning factor” going forward.

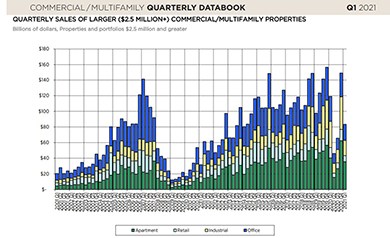

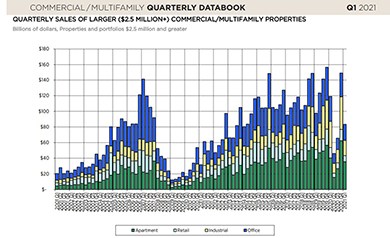

On Wednesday, the Mortgage Bankers Association released its first quarter Commercial/Multifamily DataBook.

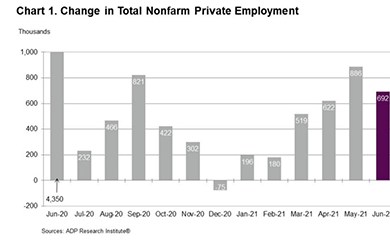

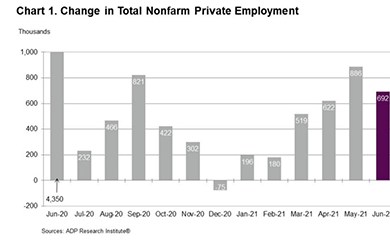

In the first of three reports this week gauging the state of U.S. employment, ADP, Roseland, N.J., said private-sector employers added 692,000 jobs in June.

MISMO®, the real estate finance industry standards organization, seeks public comment on a proposed standard for Commercial Green Utility Data. The 90-day comment period begins June 30 and runs through September 30.

On Tuesday the U.S. Supreme Court in, a 5-4 ruling, declined to lift the national Center for Disease Control and Prevention’s residential eviction moratorium. The ruling responds to a request to lift the D.C. Federal District Court’s stay, which has effectively paused its order invalidating the CDC moratorium. Presumably, the CDC eviction moratorium will expire on July 31.

The Mortgage Bankers Association and more than a dozen industry trade groups warned Congress that legislation and a separate Biden Administration proposal to change longstanding tax laws on “carried interest” could have damaging implications for Americans who use partnerships to develop, own and operate real estate.

Marcus & Millichap, Encino, Calif., arranged a sale of nine hospitality properties across nine states to Lockwood Development Partners, totaling 1.55 million square feet with a value of $225 million.

The Mortgage Bankers Association issued a Call for Speakers for its Regulatory Compliance Conference, taking place Sept. 12-14 at the Grand Hyatt in Washington, D.C. Speaker proposals are due Friday, July 1.

With recent events leading to a massive increase in the use of RON, borrowers have seen they can close on their mortgage from the convenience of their kitchen table, and they’re wondering why that can’t always be the case.

Future market offerings and IT system delivery are being altered by the exponential expansion of granular, stackable aaS solutions. For industry leaders unaccustomed to using cross-industry building blocks and iterations of offerings, they will find declining profitability against rising industry disintermediation against their core products and services.

To extend Remote Online Notarization legislation nationwide, lenders are going to have to get their “back up off the wall” and join MBA efforts to press rulemakers for laws that enable homebuyers and the real estate finance industry to benefit from modern business practices that so many other industries already enjoy.

As competition heats up in the face of the anticipated slowdown in mortgage demand, adjustable-rate loans will become an important competitive tool for many loan originators.