BREAKING NEWS

Loans in Forbearance Fall to 3.87%; Applications Dip in MBA Weekly Survey

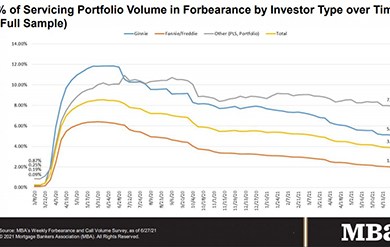

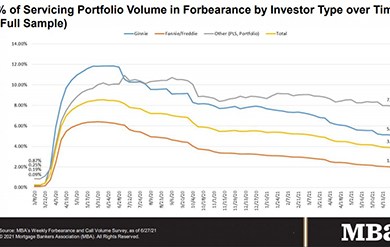

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 4 basis points to 3.87% of servicers’ portfolio volume as of June 27 from 3.91% the prior week. MBA estimates 1.9 million homeowners are in forbearance plans--the first time that two million or fewer homeowners have been in forbearance plans since March 2020, at the onset of coronavirus pandemic.

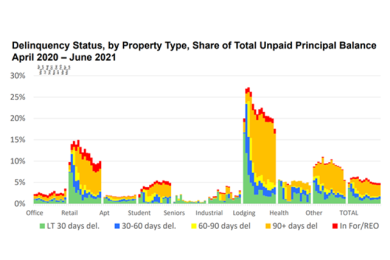

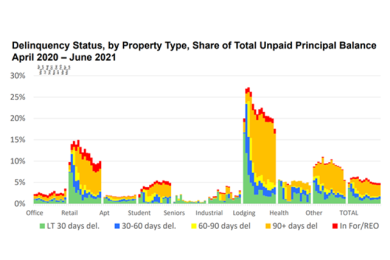

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association's latest monthly CREF Loan Performance Survey said.

Mortgage applications fell again last week, the Mortgage Bankers Association reported Wednesday—not as sharply as they did the previous week, but enough to their lowest level since before the coronavirus pandemic.

The Mortgage Bankers Association, in a July 6 letter to the Federal Housing Finance Agency, asked FHFA for more definitive guidance on the government-sponsored enterprises’ policies on mortgages for properties that include short-term rental units.

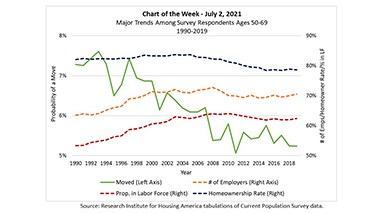

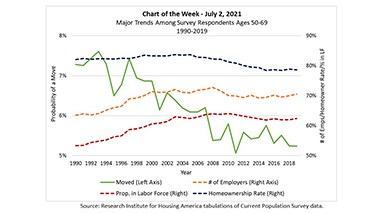

The Research Institute for Housing America, MBA’s think tank, released a special report that examines why, since the 1990s, older workers’ labor force participation has increased while their migration has decreased, counter to conventional economic wisdom.

JLL, Chicago, reported real estate investment trust merger and acquisition activity is rebounding.

Berkadia recently closed $146.2 million in multifamily transactions in Virginia.

Laird Nossuli is CEO of iEmergent, Urbandale, Iowa, an analytics and advisory firm that helps lenders leverage data and diversity to develop sustainable lending strategies. Her educational background in community development and her passion for housing equity fuel her participation as a Steering Committee member in CONVERGENCE Columbus and led to iEmergent’s role as a national partner.

The Mortgage Bankers Association announced Teressa Lurk, Vice President of Marketing and Design, was recognized by HousingWire as a recipient of the publication’s inaugural 2021 Marketing Leader award, which recognizes creative and influential marketing minds in the housing industry.

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno keynotes the mPower Luncheon on Tuesday, Oct. 19.

On Tuesday the U.S. Supreme Court in, a 5-4 ruling, declined to lift the national Center for Disease Control and Prevention’s residential eviction moratorium. The ruling responds to a request to lift the D.C. Federal District Court’s stay, which has effectively paused its order invalidating the CDC moratorium. Presumably, the CDC eviction moratorium will expire on July 31.

With recent events leading to a massive increase in the use of RON, borrowers have seen they can close on their mortgage from the convenience of their kitchen table, and they’re wondering why that can’t always be the case.

The Federal Housing Finance Agency issued a Policy Statement on Fair Lending. The Policy Statement communicates FHFA's commitment to comprehensive fair lending oversight of Fannie Mae, Freddie Mac and the Federal Home Loan Banks and provides a foundation for building out FHFA's fair lending program.