June Commercial, Multifamily Mortgage Delinquencies Hold Steady

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey said.

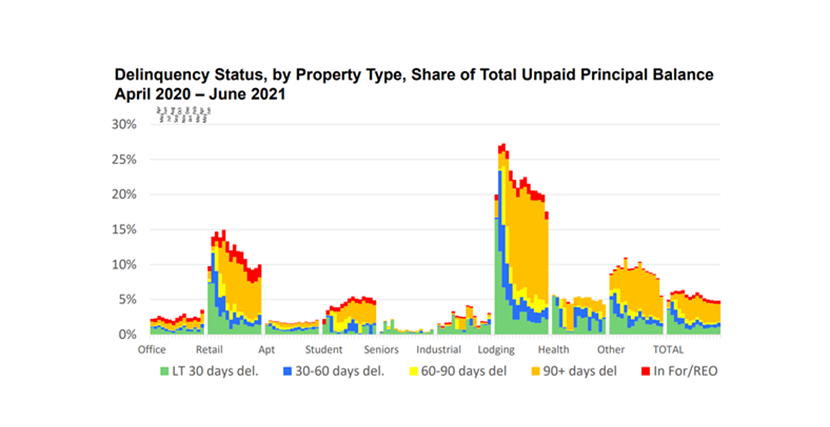

“Commercial and multifamily mortgage delinquencies continue to be driven by loans backed by hotel and retail properties that ran into trouble during the pandemic and are now more than 90 days late,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “We expect these late-stage delinquencies to wane as the economy continues to open up and there is less uncertainty surrounding the prospects of these and many other property types.”

Key Findings from MBA’s CREF Loan Performance Survey for June:

The balance of commercial and multifamily mortgages that are not current held steady in June.

- 95.2% of outstanding loan balances were current, unchanged from May.

- 3.0% were 90-plus days delinquent or in REO, down from 3.1% a month earlier.

- 0.2% were 60-90 days delinquent, unchanged from a month earlier.

- 0.6% were 30-60 days delinquent, up from 0.5% a month earlier.

- 1.1% were less than 30 days delinquent, up from 1.0%.

Loans backed by lodging and retail properties continue to see the greatest stress, but lodging loans did see a noticeable improvement in June.

- 17.6% of the balance of lodging loans were delinquent, down from 20.0% a month earlier.

- 10.0% of the balance of retail loan balances were delinquent, up from 9.5% a month earlier.

- Non-current rates for other property types were at lower levels during the month.

- 3.1% of the balances of industrial property loans were non-current, up from 1.9% a month earlier.

- 3.5% of the balances of office property loans were non-current, up from 2.4% a month earlier.

- 2.1% of multifamily balances were non-current, up from 1.8% a month earlier.

Because of their concentration of hotel and retail loans, commercial mortgage-backed securities loan delinquency rates are higher than other capital sources.

- 8.1% of CMBS loan balances were non-current, down from 8.2% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.7% of FHA multifamily and health care loan balances were non-current, up from 2.4% a month earlier.

- 3.2% of life company loan balances were non-current, up from 2.0% from a month earlier.

- 1.0% of GSE loan balances were non-current, down from 1.2% a month earlier.

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of June 20. This month’s results build on similar monthly surveys conducted since April 2020. Participants reported on $1.9 trillion of loans, representing approximately half of the total $3.9 trillion in commercial and multifamily mortgage debt outstanding.

Click here for more information on MBA’s CREF Loan Performance Survey.