Turning the Corner? Mortgage Delinquencies See 1st Annual Decrease in More than a Year

CoreLogic, Irvine, Calif., said all stages of mortgage delinquency except for the serious delinquency rate improved on an annual basis for the first time since March 2020.

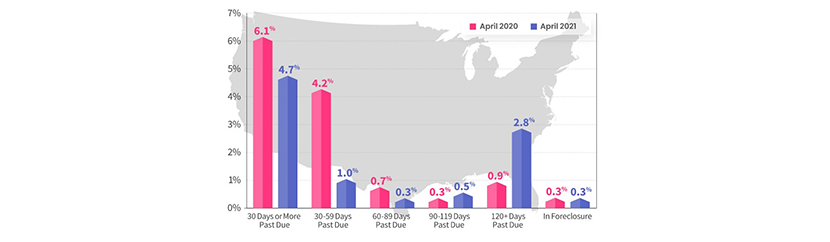

The company’s monthly Loan Performance Insights Report for April said 4.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), a 1.4-percentage point decrease in delinquency a year ago, when it was 6.1%, marking the lowest rate in a year. Other key findings:

–Early-Stage Delinquencies (30 – 59 days past due): 1%, down from 4.2% a year ago.

–Adverse Delinquency (60 – 89 days past due): 0.3%, down from 0.7% a year ago.

–Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.3%, up from 1.2% a year ago.

–Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from April 2020.

–Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 3.4% a year ago.

–Nearly all states logged a decrease in annual overall delinquency rates (only Wyoming experienced a slight increase with a 0.1 percentage-point uptick), and a significant portion of metro areas posted at least a small annual decrease, with only eight experiencing a year-over-year increase.

–Among metros, Odessa, Texas, still recovering from job losses in the oil industry, had the largest annual overall delinquency increase with 2.4 percentage points. Other metro areas with significant overall delinquency increases included Midland, Texas (up 2.3 percentage points); Lake Charles, La. (up 0.8 percentage points); Enid, Okla. (up 0.7 percentage points) and Casper, Wyo. (up 0.6 percentage points).

“The sharp rebound in the economy, as well as a potent combination of government fiscal and regulatory help, is fueling unprecedented demand for residential housing and enabling people to buy and stay in their homes,” said Frank Martell, president and CEO of CoreLogic. “The drop in delinquency rates is a further manifestation of the benefits of these tail winds. Barring an unforeseen change, we expect rates to continue to fall and home prices rise over the next 12-to-18 months.”