MBA Chart of the Week July 6 2021: Older Workers’ Labor Force Participation

On June 29, the Research Institute for Housing America, MBA’s think tank, released a special report that examines why, since the 1990s, older workers’ labor force participation has increased while their migration has decreased, counter to conventional economic wisdom.

Brian Asquith of the W.E. Upjohn Institute used detailed Current Population Survey and Health and Retirement Study microdata to analyze if this phenomenon is being driven by changes in the housing market, in the labor market, or both. The report provides a rich set of results (highlighted in MBA’s press release).

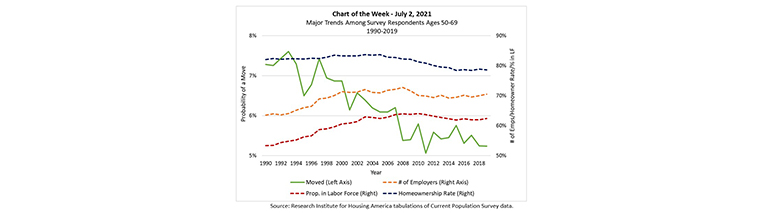

This week’s MBA Chart of the Week illustrates the central problem examined in the paper by graphing migration, labor force participation and homeownership rates, as well as the number of non-consecutive employers in the past year (a proxy for job changing) for survey respondents ages 50-69. The graph underscores that while the fall in homeownership appears to be related to the Great Recession, the fall in migration is long-standing, and the increase in labor force participation occurred throughout the 1990s and the 2000s.

Asquith drills down into various subgroups—by college level, homeownership status, and metropolitan area economic standing—and finds strong compositional effects (i.e., that responses to negative economic shocks differ by group). For example, he finds that older homeowners and college-educated individuals are more inclined than renters to retire or leave the workforce after losing their job. He surmises that older renters seem to be more reluctant than homeowners to leave the labor force in response to any adverse event, possibly because they are worried about paying for their rents in the future when they expect to be living on a fixed income. Unsurprisingly, this means that older homeowners, particularly those without a college degree, really seem to value having their homes as a buffer against these same adverse events.

Asquith emphasizes that his research “highlights both opportunities and downsides for the mortgage market. The college-educated share of older Americans is rising, and degree holders have higher homeownership rates. Meanwhile, both an aging population and rising regional inequality in home prices will continue to dampen migration, potentially hurting demand for new mortgages in some areas.”

- Edward Seiler (eseiler@mba.org)