Black Knight: Annual Home Price Growth Hits 3rd Straight Record High

Black Knight, Jacksonville, Fla., said home price growth hit its third straight record high—and the market might not be done yet.

The company’s monthly Home Price Index reported home prices surged by nearly 18 percent in May, with the annual rate of appreciate accelerating by more than 2% in each of the past two months. And the report said sales data for the first three weeks of June from Black Knight’s Collateral Analytics suggest further acceleration may come, as median sales prices of single-family residences increased by 25% year-over-year.

“Frankly, home values are appreciating at rates we’ve simply never seen before, as low interest rates, ultra-scarce inventory and increasingly competitive homebuyers combine to create a truly unprecedented market,” said Black Knight Data and Analytics President Ben Graboske.

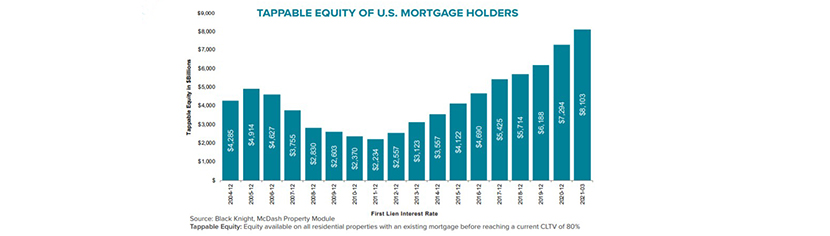

Such strong price growth, the report said, has sent homeowners’ levels of tappable equity soaring by $800 billion in the first quarter alone, a 23% year-over-year gain, setting yet another record high of $8.1 trillion.

“Obviously, as home values increase, so do levels of available, tappable equity,” Graboske said. “In turn, rising equity levels provide homeowners with more refinance options – switching from an FHA to a GSE loan, for example, to both lower a borrower’s interest rate and potentially eliminate mortgage insurance payments at the same time.”

Indeed, the report’s eMBS agency securities data showed the Ginnie Mae share of the refinance market declining noticeably since the onset of the pandemic while the GSE share has increased, with such FHA-to-GSE refis one likely driver. Data on securitizations by purpose shows the Ginnie mae share of purchase lending has also been declining, falling below 40% in both April and May for the first time in recent history. Conversely, the GSE share of purchase lending has increased, Graboske said.

“Back then, Ginnie Mae securities – comprised primarily of FHA and VA loans – made up about a third of agency securitizations; today they’re less than 25%,” Graboske said. “In contrast, the share of GSE purchase lending has increased as stricter FHA property inspection requirements may be making for less attractive offers in today’s hyper-competitive real estate market, when sellers are often choosing between multiple offers and looking for any reason to thin the herd.”

The report also found that, with tappable equity at record highs and interest rates remaining relatively low, cash-outs are starting to make up a larger share of refinance lending, especially with rate/term refis on the decline. Nearly half of all tappable equity – the amount available to a homeowner with a mortgage to borrow against before hitting a maximum 80% combined loan-to-value ratio – is held by borrowers with current interest rates of 3.75% or higher, providing many homeowners with the opportunity to simultaneously reduce their interest rates while also tapping into record levels of available equity.

On the other side of the spectrum, nearly a quarter of tappable equity is held by borrowers with sub-3% interest rates. “This could create increased demand for second lien home equity lending, including HELOCs, in coming years should 30-year rates continue to rise, making cash-out refinances a less attractive route to accessing equity for such homeowners,” the report said.

The report can be found here.