Other Home Price Forecasts: Full Steam Ahead—Maybe

Add Veros Real Estate Solutions, Santa Ana, Calif., to the list of forecasters who say home price appreciation won’t let up any time soon. And add Fitch Ratings, New York, to those saying the home price train can’t run forever, with some markets highly overvalued.

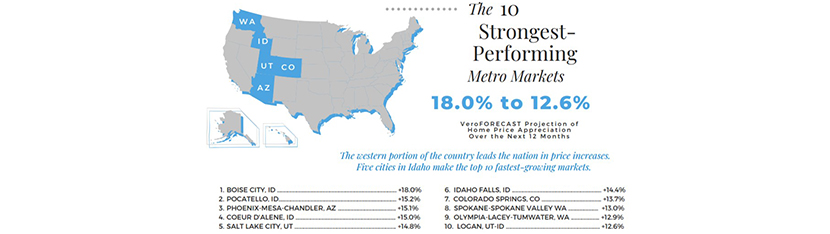

The Veros quarterly VeroFORECAST anticipates home prices will continue to appreciate at high levels during the next 12 months in the 100 most-populated markets by 7%, heavily driven by robust markets, primarily in the West. Five of the strongest-performing markets are in Idaho.

“Buyer demand is strong in nearly every market in the country,” said Darius Bozorgi, CEO of Veros Real Estate Solutions. “We are squarely in a seller’s market and buyers have no choice but to put forward the best offer they can, frequently making offers above asking price, to secure the home they want to own.”

“Right now, buyers are acting on pent-up demand and sellers are seeking top dollar for their homes,” said Eric Fox, Veros Real Estate Solutions Chief Economist. “The tight inventory of for-sale homes, coupled with low interest rates are keeping prices strong across the country.”

The record-low interest rate environment is likely to be in place for the foreseeable future. “The Federal Open Market Committee participants recently indicated that risks to inflation were weighted to the upside,” Fox said. “Despite that, they have not slowed the pace of bond buying. They have their foot on the accelerator full speed ahead and are only thinking about discussing slowing down.”

The West leads the nation in price increases, with cities in Arizona, Colorado, Idaho, Utah and Washington comprising the entirety of the Top 10 metro areas—all of these top markets have double-digit appreciation values above 12%. The forecast calls for Boise, Idaho, to be up an 18% by Q2 2022. Four other markets in Idaho are among the top 10 markets including Pocatello, Coeur d’Alene, Idaho Falls and Logan, Utah. The report said many of these markets are benefiting from population in-migration as consumers move around the country.

Interestingly, the Fitch report called some of those same markets “overvalued,” particularly in Idaho and Nevada.

Fitch agreed rapid growth in U.S. home prices would continue its momentum with lack of supply and low mortgage rates remaining key drivers. The company’s quarterly U.S. sustainable home price report noted national home prices grew by 3.4% in the first quarter, much of it from limited supply and continued demand. Fitch estimated national home prices are 9.8% overvalued on a population-weighted average basis, based on underlying economic fundamentals, compared to 8.2% for year-end 2020.

“New home supply has been an issue since the 2008 housing crisis and the pandemic has worsened the imbalance,” said Fitch Analyst Suzanne Mistretta. “However, potential for higher mortgage rates could pressure affordability and augur a possible slowdown in home price growth in 2022.”

The report said favorable mortgage rates and the demand/supply imbalance caused home prices to continue to accelerate, while unemployment levels flattened and personal income levels received further support from a third round of fiscal stimulus.

Fitch estimated home prices in 41% of the country’s metropolitan statistical areas are more than 10% overvalued. Idaho and Nevada remain the most overvalued states. Among the top 50 most populated MSAs, Las Vegas is estimated to be the most overvalued region.

Veros said cities that appear on the list of 10 least-performing markets are in Illinois, Iowa, Louisiana, North Dakota and Texas. Of the 100 most-populated markets, markets that will see the slowest growth, and a potential decline, are located in Texas oil country – Odessa and Midland – although other markets in Texas are expected to do very well.

Fitch forecasts home prices will continue to grow in 2021, as evidenced by the record-high 23.6% year-over-year increase in median existing home prices in May, according to the National Association of Realtors. Fitch attributes the rise to ongoing limited supply, rising construction costs, and strong demand due to low mortgage rates and permanent remote-work opportunities.

“The factors behind the rapid growth over the past 12-18 months are not considered fundamental to sustained values,” the report said. “The potential for higher mortgage rates, which could further pressure affordability, and increased inventory, when foreclosure moratoriums are lifted and not extended, could take the steam out of future home price growth. Builder sentiment, typically an indicator of home prices, has softened this year, pointing to a possible slowdown in price growth next year.”

Fitch said rising construction material costs is another key factor pushing home prices higher. Over the past 20 years, the U.S. has experienced three shifts in housing construction cost trends. From 2002-2003, the highest concentration of new construction was in the under $70 per square foot category. From 2004-2015, practices shifted to a greater emphasis on medium-priced construction, with the median price of construction at approximately $90psf. Since then, the most recent shift from 2015 onward has seen a majority of new construction concentrated in the high-price market (above $100psf). In 2020, only 28% of new homes cost less than $100psf, compared with 48% in 2015. Generally, with the exception of the immediate years following the post-2008 financial crisis, prices of homes sold have trended along with construction prices.

Additionally, the pandemic and resulting remote-work arrangement have accelerated the move to suburban areas, driving housing demand. Fitch expects this demand will persist even with the re-opening of workspaces as most workers are not expected to return to the office five days a week.