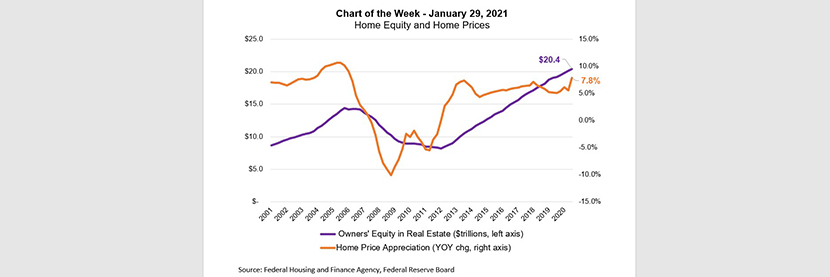

MBA Chart of the Week: Home Equity and Home Prices

Homeowners’ equity in housing was at a record high of $20.4 trillion in the third quarter. The steady upward trend since 2012 was spurred by accelerating home-price growth and low mortgage rates, which have helped many households build equity in their homes.

The third quarter’s year-over-year increase in home prices was 7.8 percent, the highest since 2006. The most recent monthly data point from the FHFA for November 2020 showed an increase of 11.0 percent, the highest year-over-year growth rate in the series and surpassing the previous high of 10.7 percent in 2005.

Home prices are expected to continue to increase in 2021, as demand for housing stays elevated and outpaces record-low inventory levels. The interest in homebuying is high, even as the economy and job market have yet to return pre-pandemic levels of activity. However, we expect the pace of home-price growth to slow, as home building continues to ramp up and housing inventory loosens.

MBA conducts an annual home equity lending study that includes benchmarking data – volume, utilization rates, operational metrics, and growth expectations – related to lending and servicing open-ended Home Equity Lines of Credit (HELOCs) and closed-end Home Equity Loans (HE Loans). Last year’s study documented that despite a challenging year, lenders expected home equity originations to bounce back in 2021. Lenders anticipated annual HELOC originations to drop 2.9 percent in 2020 before growing 10.8 percent in 2021. Annual originations of HE loans were forecasted to increase by 0.5 percent in 2020 and 9.0 percent in 2021. This year’s study kicks off in two weeks. Register today.

–Joel Kan jkan@mba.org.