Early January mortgage rate declines unlocked refinance opportunities for nearly five million borrowers and helped push affordability to a four-year high, according to ICE Mortgage Technology, Atlanta.

Tag: Home Equity

Cotality: Home Equity Continues to Dip

Cotality, Irvine, Calif., released its Homeowner Equity Report for Q3 2025, finding borrower equity decreased year-over-year by 2.1%.

Cotality: Home Equity Picture Mixed in Q2

Cotality, Irvine, Calif., released its Homeowner Equity Report for Q2, reporting that the average U.S. homeowner lost approximately $9,200 in equity over the past year.

Transunion: Total Tappable Home Equity Remains High

Transunion, Chicago, released its Q2 Home Equity Report, finding that total tappable home equity stands at $21.5 trillion, up 5% year-over-year.

Home Equity Growth Varies Across the U.S., Bankrate Reports

Certain parts of the country have seen higher home equity than others since 2020, according to a new study from Bankrate, New York.

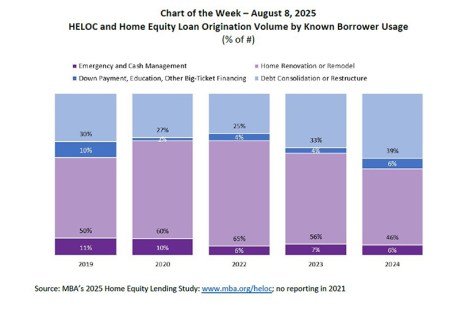

Chart of the Week: HELOC and Home Equity Loan Origination Volume by Known Borrower Usage

MBA recently completed its 2025 Home Equity Lending Study, tracking trends in origination and servicing for home equity lines of credit (HELOCs) and home equity loans.

MBA Home Equity Study Shows Increase in Originations, Debt Outstanding in 2024

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased in 2024 by 7.2% from the previous year when comparing originators that reported in both years.

ATTOM: Home Equity Dips Slightly in Q1

ATTOM, Irvine, Calif., released its Q1 Home Equity and Underwater Report, revealing that 46.2% of mortgaged residential properties were considered equity-rich in the first quarter.

Home Improvements Top Reason to Tap Home Equity, Bankrate Reports

More than half of current homeowners (55%) see home improvements or repairs as a good reason to access built-up home equity, according to Bankrate, New York.

Q&A with Lender Price’s Dawar Alimi: How Product Depth is Helping Lenders Drive Volume, Reduce Cost

MBA Newslink recently interviewed Dawar Alimi, CEO and Co-Founder of Lender Price, to discuss the significance of lenders having product depth to drive additional volume, how automation is driving cost reduction and overall efficiencies and the evolving role of technology in shaping mortgage lending.