MBA Advocacy Update Feb. 16 2021

On Thursday, the House Financial Services Committee passed legislation along party lines that includes key housing provisions of President Biden’s $1.9 trillion American Rescue Plan. On Tuesday, the Federal Housing Finance Agency extended its foreclosure and eviction moratorium for Enterprise-backed, single-family mortgages and REO properties through March 31. FHFA also announced it would extend GSE origination flexibilities through March 31.

MBA Launches Licensing Flexibility Campaign with State Partners

The Mortgage Bankers Association recently launched a new campaign with its state and local association partners aimed at updating state law and rules to provide mortgage loan originators and their state licensed employers greater flexibility for remote location work arrangements during—and especially beyond—the coronavirus pandemic.

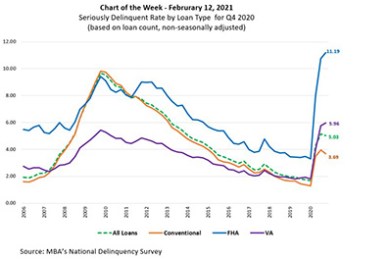

MBA Chart of the Week: NDS Seriously Delinquent Rate By Loan Type

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

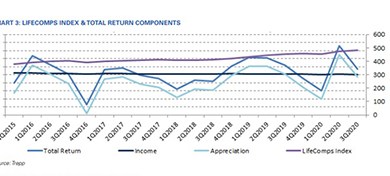

Life Insurance Commercial Mortgage Return Index Stabilizes

Trepp, New York, said commercial mortgage investments held by life insurance companies remained positive in late 2020 for the third consecutive quarter.

MBA Awards $165,000 in Path to Diversity Scholarships

The Mortgage Bankers Association awarded more than $165,000 in scholarships to 192 women and minorities through its Path to Diversity (P2D) Scholarship Program during fiscal year 2020.