STRATMOR: Many Lenders Buying, But Not Fully Implementing Technology

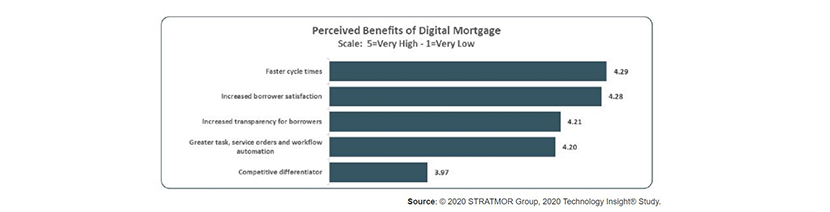

(Chart courtesy STRATMOR Group.)

A new study by STRATMOR Group, Greenwood Village, Colo., found while mortgage lenders have been buying and installing technology at a rapid pace since the COVID-19 pandemic began, many aren’t actually using it to their full potential.

“Lenders ramped up with more people and pushed harder on technology, buying and installing at a maddening pace,” said STRATMOR Senior Partner Garth Graham, writing in the company’s latest Insights Report. “Lenders are rushing to deploy the tools, but only about half the eligible users (internal and consumer) are adopting the tools they are provided. They are spending money on technology but are struggling in terms of adoption. Part of that has to do with getting the new tools installed, configured and ready to go.”

The article, “Digital Rising: The Mortgage World According to Garth,” addresses findings and includes data from STRATMOR’S most recent Technology Insight Study. STRATMOR asked lenders which digital capabilities they had already installed and made available for use by their teams. The top digital capabilities that lenders have already deployed include online disclosures, borrower uploading capabilities, appraisal data submission, eSignatures and eClosing technology.

The study found lender investments in technology are going up. Retail lenders spent almost $800 per loan on technology by the first half of 2020, up from less than $400 per loan five years earlier. However, the total cost of origination has not gone down. In fact, lenders’ production costs are higher than they were in 2016, despite the big bump up in volume in the past year, the data shows.

“COVID electrified the RON business,” Graham said. “Suddenly, it became critically important for lenders to close mortgage loans without putting borrowers, closing agents or notaries in the same room together. This was exactly what the electronic notarization industry needed.”

However, eClosings did not advance in the way many expected. “Instead, we saw hybrid eClosings experience the highest gains in the Technology Insight Study, increasing by 25 percent,” Graham said. “The hybrid eClose is a safer process and offers a substantially improved experience for the consumer.”

Graham offers several recommendations to make more measurable gains with technology going forward. For starters, he advises lenders to build an effective implementation team. “The key is to have a strong team and strong governance,” he said. “Good technology implemented well is the goal, but lenders must focus on the humans in the equation because they will account for 90 percent of the cost.”

Graham said lenders should also carefully consider whether a new vendor they are considering integrates well with their existing technology. “If not, you should carefully think whether you will get the level of adoption to make it worth it,” he said. “As soon as you add an un-integrated vendor, adoption rates will suffer.”

In addition, lenders shouldn’t rely solely on their vendors when implementing new technology. “Many vendors are experts at pushing the implementation toward completion, but it may have to do with the way their payments are structured,” Graham said. “Successful lenders drive their own implementations and follow their own roadmap.”

While there is some room for improvement in implementation, advances in technology in the mortgage industry have been positive, according to Graham. “Progress is being made and lenders are working hard under a heavy workload of new mortgage business to get new technologies installed and adopted,” he said.