ANNOUNCEMENT

MBA Offices will be closed this Monday, Feb. 15 in observance of the Presidents Day holiday. MBA NewsLink will not publish on Monday. On behalf of MBA officers and staff, have a safe and healthy holiday.

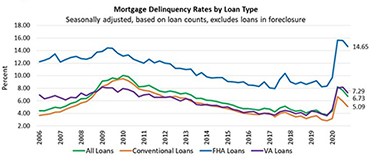

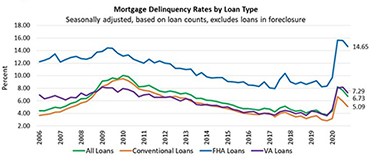

The Mortgage Bankers Association’s 4th Quarter National Delinquency Survey reported the delinquency rate for mortgage loans fell by 92 basis points from the third quarter to 6.73 percent, seasonally adjusted. From a year ago, however, mortgage delinquencies increased across the board.

The Mortgage Bankers Association awarded more than $165,000 in scholarships to 192 women and minorities through its Path to Diversity (P2D) Scholarship Program during fiscal year 2020.

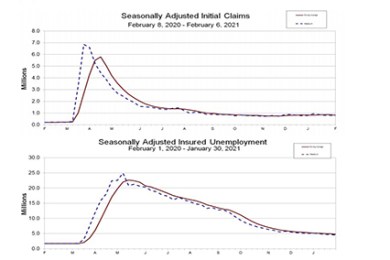

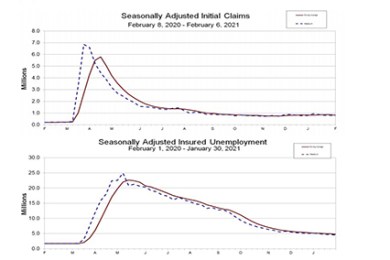

Initial claims for unemployment insurance fell last week, the Labor Department reported, but an upward revision to the previous week’s results negated any progress toward a normalizing economy.

The multifamily sector is performing better than anticipated during the pandemic, increasing optimism for the future among mortgage bankers and investment sales advisors, reported Berkadia, New York.

The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes, with Wells Fargo Bank N.A. at the top with $712 billion in master and primary servicing.

Walker & Dunlop, Bethesda, Md., structured $205 million in financing for 619 West 54th St., a Class A life science and medical office property in Manhattan's Midtown West neighborhood.

Tom Pearce is a co-founder of MAXEX, Atlanta, and serves as its CEO and Chairman of the Board. He brings more than 30 years of expertise within the community banking and insurance arenas as well as expertise within the mortgage finance, credit and asset management arenas.

MBA NewsLink talked with Dane Smith, President of Verus Mortgage Capital, Washington D.C., about why the firm has chosen to work with correspondent lenders to build its portfolio of Non-Qualified Mortgage assets.

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MISMO, the industry standards organization, has instituted a $0.75 per loan Innovation Investment Fee.

MBA is proud to recognize its Premier and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

MBA recognizes its Select Associate Members and thanks them for their continued support of MBA and the real estate finance industry.