MBA: 4th Quarter Delinquencies See Decline from 3Q, Up from Year Ago; Foreclosure Inventory at Near 40-Year Low

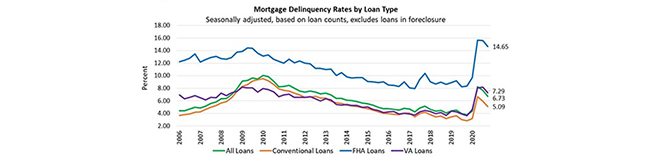

The Mortgage Bankers Association’s 4th Quarter National Delinquency Survey reported the delinquency rate for mortgage loans fell by 92 basis points from the third quarter to 6.73 percent, seasonally adjusted. From a year ago, however, mortgage delinquencies increased across the board.

The delinquency rate fell by 92 basis points from the third quarter but rose by 296 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter remained unchanged from past two quarters at a survey-low 0.03 percent.

“For the second consecutive quarter, homeowners’ ability to make their mortgage payments improved,” said Marina Walsh, CMB, MBA Vice President of Industry Analysis. “The 92-basis-point drop in the delinquency rate in the fourth quarter was the biggest quarterly decline in the history of MBA’s survey dating back to 1979. Total mortgage delinquencies across the three loan types – conventional, FHA and VA – and across the major stages of delinquency – 30-day, 60-day and 90-day – declined from last year’s third quarter.”

Walsh said the decline in mortgage delinquencies at the end of 2020 only tells part of the story. She noted delinquencies track closely with unemployment, and while the unemployment rate fell from an April peak of 14.8 percent to 6.3 percent in January, there remain 6.5 percent fewer jobs than before the pandemic.

The report noted homeowners in service industries such as leisure and hospitality are facing longer-term hardships, and are more likely to have FHA and VA loans. At the end of the fourth quarter, the seriously delinquent rate for FHA and VA loans reached record highs of 11.19 percent and 5.96 percent, respectively.

“Mortgage forbearance, foreclosure moratoriums, enhanced unemployment benefits and stimulus payments have helped distressed homeowners remain in their homes,” Walsh said. “In the short-term, additional stimulus and homeowner relief is likely necessary until economic growth picks up later this year. Longer-term, loss mitigation alternatives such as permanent modifications, payment deferrals, and loan payoffs – through either a refinancing or home sale – may be needed for these homeowners to recover.”

Key findings of the MBA Fourth Quarter 2020 National Delinquency Survey:

• Compared to the third quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 8 basis points to 1.78 percent, the lowest rate since the survey began in 1979. The 60-day delinquency rate decreased 25 basis points to 0.77 percent, while the 90-day delinquency bucket decreased 60 basis points to 4.18 percent.

• By loan type, the total delinquency rate for conventional loans decreased 84 basis points to 5.09 percent over the previous quarter. The FHA delinquency rate decreased 94 basis points to 14.65 percent, while the VA delinquency rate decreased by 87 basis points to 7.29 percent.

• Year-over-year, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased by 227 basis points for conventional loans, increased 627 basis points for FHA loans and increased 365 basis points for VA loans.

• The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter fell to 0.56 percent, down 3 basis points from the third quarter and 22 basis points lower than one year ago. This is the lowest foreclosure inventory rate since second quarter 1982.

• The seriously delinquent rate—the percentage of loans 90 days or more past due or in the process of foreclosure, fell to 5.03 percent. It decreased by 13 basis points from the third quarter but increased by 327 basis points from last year. The seriously delinquent rate decreased 26 basis points for conventional loans, increased 43 basis points for FHA loans and increased 19 basis points for VA loans from the previous quarter. From a year ago, the seriously delinquent rate increased by 232 basis points for conventional loans, increased 772 basis points for FHA loans and increased 404 basis points for VA loans.

• States with the largest year-over-year increases in their overall delinquency rate were Nevada (494 basis points), Hawaii (446 basis points), New Jersey (435 basis points), New York (424 basis points) and Florida (419 basis points).

• Note: An estimated 2.7 million homeowners were on forbearance plans as of January 31. For purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The NDS covers 39 million loans on one- to four- unit residential properties. Loans surveyed were reported by more than 100 servicers, including independent mortgage companies, and depositories such as large banks, community banks and credit unions.