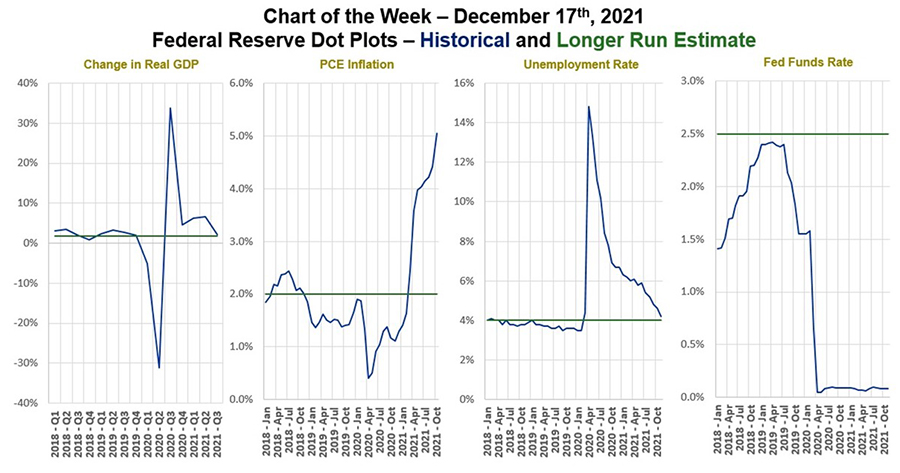

MBA Chart of the Week Dec. 17 2021: Federal Reserve Dot Plots

Source: U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, Federal Reserve Board.

Inflation is running well above target, and the job market is booming. It was no surprise that the Federal Reserve’s FOMC statement released on Wednesday announced an acceleration of their tapering of Treasury and MBS purchases, and signaled that the first rate hike will be coming sooner rather than later. Moreover, the median FOMC member now expects three rate hikes in 2022 compared to expectations of a single rate hike in the previous statement.

This week’s MBA Chart of the Week traces the FOMC forecasts and long-run estimates of four key metrics that contribute to Fed decision-making and communication – GDP, inflation, unemployment and the Fed funds rate. The Fed’s outlook for economic growth and labor market health in 2022 have improved, while their forecast for inflation has worsened. While market participants likely anticipated this change to their asset purchases, the more hawkish view with respect to rate hikes may well have surprised the market. Inflation was initially thought to be short-lived, as the economy rebounded from the sharp slowdown in 2020. However, a combination of supply chain complications, labor shortages, and increased consumption of goods over services have continued to push prices higher for most industries.

As it relates to housing, mortgage rates have been kept lower than they otherwise would have been through the Fed’s purchases of longer-term Treasuries and MBS. Going forward, MBA forecasts that the 30-year fixed mortgage rate will rise to 4% by the end of 2022 and may be more volatile as the Fed backs away from the market, having been such a large purchaser of MBS for so long. Although this will lead to a drop in refinances, we expect that the strong economy will support an increase in home sales and single-family purchase originations in 2022.

- Mike Fratantoni mfratantoni@mba.org; Jamie Woodwell jwoodwelll@mba.org.