BREAKING NEWS

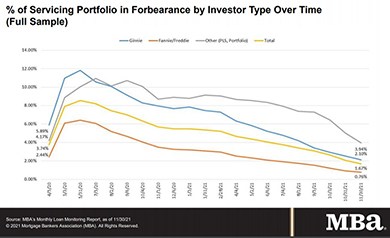

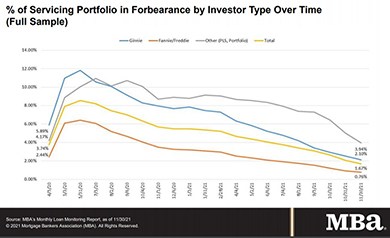

MBA Releases Inaugural Monthly Loan Monitoring Survey; Loans in Forbearance Fall to 1.67%

The Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported loans now in forbearance decreased by 39 basis points to 1.67% of servicers’ portfolio volume as of November 30 from 2.06% in October. MBA estimates 835,000 homeowners remain in forbearance plans.

So many reports, so little time. Here’s a roundup of recent housing market reports that came across the MBA NewsLink desk:

The Consumer Financial Protection Bureau and the Department of Justice on Monday issued two joint letters Monday on legal housing protections for military families.

Commercial mortgage-backed securities liquidation volume bounced back after a pandemic-related pause, analysts said.

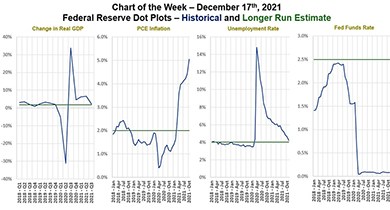

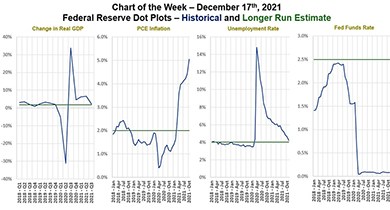

This week’s MBA Chart of the Week traces the Federal Open Market Committee forecasts and long-run estimates of four key metrics that contribute to Fed decision-making and communication – GDP, inflation, unemployment and the Fed funds rate.

MBA Senior Vice President of Legislative and Political Affairs Bill Killmer and MBA Associate Vice President of Legislative Affairs Tallman Johnson were named to The Hill’s annual list of “Top Lobbyists” for 2021.

The nomination period for the MBA NewsLink 2022 Tech All-Star Awards is underway with a new, simplified entry form. Nominations will be accepted through Friday, Jan. 21.

Avison Young’s Florida Capital Markets Group completed the $105 million sale of Biscayne Place, a three-acre residential and mixed-use development property.

For c-levels, the unknowns of 2022 represent a nightmarish Christmas Carol outcome. From technologies to personnel to regulatory compliance to political alignments to non-traditional competition to comprehensively unique business models, the sustainability challenges for financial services firms have never been greater.

Thomas (Tom) Price is President of Incenter Insurance Solutions, Fort Washington, Pa.

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. Today we delve into the bevy of activity surrounding vendor mergers and acquisitions.

Souren Sarkar, CMB, is founder and CEO of Nexval, (U.S. headquarters Pompano Beach, Fla.), a business process outsourcing and fintech provider specializing in the mortgage industry. He has more than 25 years of experience as a technology leader in the mortgage and banking arena.

Clear Capital, Reno, Nev., launched ClearPhoto, a set of AI-driven rules built into ClearCollateral Review, automating the review of property photos and ensuring they are aligned with the appraisal data and sketch.