By the Numbers: 10 Housing Records Set in 2021

The coronavirus pandemic and the resulting surge in remote work have changed where, when, why and how people buy homes, reported Redfin, Seattle, resulting in nearly a dozen housing market records in the past year.

“The ongoing pandemic, including its seismic effect on the U.S. economy and the way Americans live and work, has made 2021’s housing market anything but typical,” said Redfin Chief Economist Daryl Fairweather. “Remote work, low mortgage rates, a shortage of building materials and wealth inequality that has allowed an influx of affluent Americans to buy vacation homes, to name just a few factors, have come together to create a historic year for real estate. Buyers paid more for homes, bought sooner than they planned, searched outside their hometowns or all of the above. This year’s frenzied housing market has been one for the books—but it may become more balanced in 2022.”

Redfin summarized 10 records set in the 2021 housing market:

- Home Prices. The national median home-sale price hit a record $386,000 in June, up 24.4% year over year—and it might not be done, yet. U.S. home prices have been growing by double digits all year, thanks to low inventory and high demand. Prices are much higher than they were pre-pandemic in just about every part of the country.

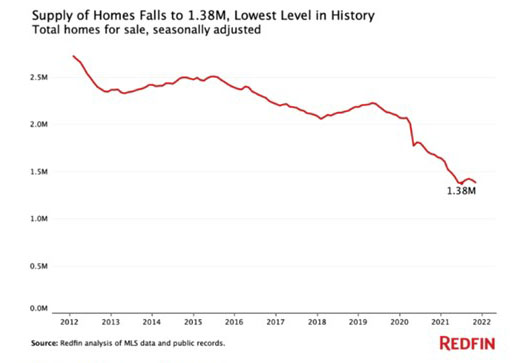

- Home Supply—or Lack Thereof. Redfin reported a record-low 1.38 million homes for sale in June on a seasonally adjusted basis. Fairweather said the U.S. is in a housing-supply shortage for several reasons: a lack of new construction, surging demand from buyers, and homeowners taking advantage of low mortgage rates to refinance rather than sell.

- Time on Market. The typical home that sold in both June and July was on the market for just 15 days, the lowest median days on market in history and down from 39 days in June 2020. The speed of the market is due partly to the supply crunch, which has led buyers to pounce on homes as soon as they’re listed for sale, often without even seeing them in person.

- More than 60% of Homes Went Off Market within 2 Weeks. Redfin said 61.4% of homes that went under contract in March had an accepted offer within two weeks of hitting the market, a record high.

- More than Half of Homes Sold Above List Price.Of homes that sold in June, 56.5% went for above list price, up 29.6 percentage points from a year earlier. The average home sold for 2.6% above list price in June, another record high.

- Record-Low Mortgage Rates. The average 30-year fixed mortgage rate hit 2.65% the week ending January 7. Low mortgage rates are one reason for this year’s homebuying frenzy, which has ultimately resulted in the supply shortage and surging prices.

- Investors. Real estate investors bought a record-high 18.2% of homes purchased in the U.S. during the third quarter, up from 11.2% a year earlier. In dollar terms, investors bought a record $63.6 billion worth of homes over that period, up from $35.7 billion a year earlier. Many individual homebuyers have found it tough to compete with investors, just one factor that has made the housing market tough for buyers this year.

- Second Homes. Homebuyer demand for second homes was up a record 91% from pre-pandemic levels in January. Demand for vacation homes soared as remote work took hold in mid-2020, leaving many affluent white-collar workers with the ability to work from beach houses and ski chalets.

- Relocation. A record-high 31.5% of Redfin.com users looked to move to a different metro area in the first quarter, up from 26% from a year earlier. That’s partly due to remote workers moving to relatively affordable areas in search of larger homes, more outdoor space and sunny weather.

- Luxury Homes. The median sale price of U.S. luxury homes jumped 25.8% year over year to a record $1,025,000 in the second quarter, compared to 16% year-over-year growth for mid-priced homes and 13.2% growth for affordable homes. Price growth for luxury homes outpaced that of more affordable homes partly due to affluent Americans reaping the benefits of the year’s strong stock market, gains in home equity and remote work.