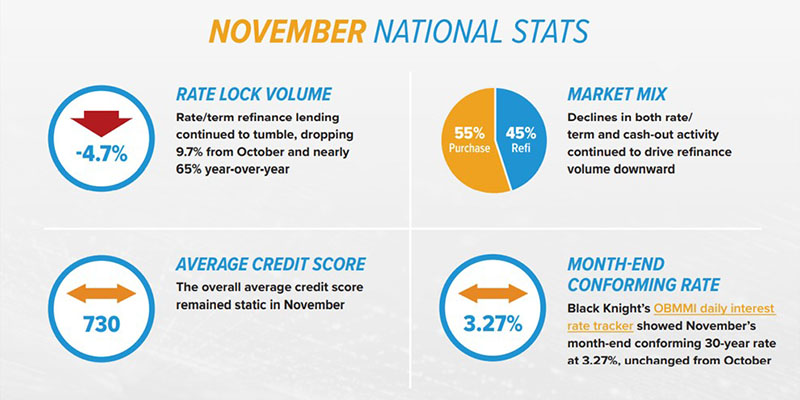

Black Knight: November Rate Locks Down 7.4%; Refis 65% Below Year Ago

Black Knight, Jacksonville, Fla., said November marked the third consecutive monthly decline in overall origination volume, bringing it to its lowest level since February 2020, prior to the onset of the pandemic.

The company’s monthly Originations Market Monitor also reported rate lock volumes fell across the board in November, driven by rate/term refinance originations dropping another 9.4% for a nearly 65% year-over-year decline. While locks on both purchase (-3.9%) and cash-out refinance (-2.5%) loans fell from October, they fell by nearly 13% and 36% from last year’s levels.

“While 30-year rates ended November relatively flat from where they were at the start of the month, there was some volatility in rate offerings throughout the month,” said Black Knight Secondary Marketing Technologies President Scott Happ. “Rates moved up and down within a roughly 21 basis point range throughout the month as the market digested news of both the Fed’s tapering announcement and the new Omicron variant.”

The report said rate/term refinance lending fell in eight of the 11 months of 2021 thus far and is now down 65% from last November’s level. The overall refinance share of the market mix remained at 45%, the lowest it’s been since June. Locks declined across the board, with cash-out refinances down 2.5% and purchase loans down 3.9%. Despite the monthly decline, cash-out lock volumes are still up nearly 36% from this time last year and continue to be buoyed by ongoing home price growth.

“While the rate of home price growth has slowed, it is still historically quite robust,” Happ said. “As a result, we continue to see non-conforming jumbo loan products gain market share at the expense of agency volumes. With higher conforming loan limits announced by the FHFA taking effect at the start of 2022, it will be interesting to see to what degree this trend persists. As it is, the average loan amount rose another $7,000 to reach $337,000 in November.”