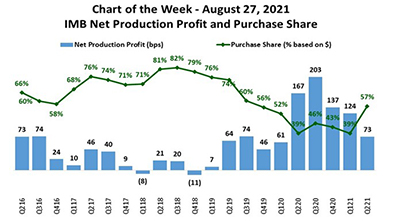

MBA Chart of the Week Aug. 30 2021: IMB Net Production Profit & Purchase Share

Source: MBA Quarterly Mortgage Bankers Performance Report.

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of 73 basis points in the second quarter, down from a reported gain of 124 basis points in the first quarter, according to last week’s release of MBA’s latest Quarterly Mortgage Bankers Performance Report.

The purchase share of originations rose to 57 percent in the second quarter, up from 39 percent in the first quarter. For the mortgage industry as a whole, MBA estimates the purchase share at 44 percent in the second quarter.

In this week’s MBA Chart of the Week, we look at net production profit in basis points, relative to the purchase share of total first mortgage originations by dollar volume over a five-year time span – second quarter 2016 through second quarter 2021. During this period, there were 11 quarters where the purchase share was above 65% and 10 quarters where the purchase share was below 65%. Net production profit for quarters when the purchase share was above 65% averaged 25 basis points. Net production profit for quarters when the purchase share was below 65% averaged 98 basis points.

In terms of overall volume, for the quarters when the purchase share was greater than 65%, average quarterly volume was $508 million per company. For the quarters when the purchase share was less than 65%, average quarterly volume was $1 billion per company.

As of August, MBA forecasts the purchase share to reach 74% in 2022 and 75% in 2023. Based on this analysis, mortgage lenders may expect a more challenging market environment in the coming years in terms of both net production profit and overall volume.

-Jenny Masoud jmasoud@mba.org; Marina Walsh, CMB mwalsh@mba.org