BREAKING NEWS

MBA Reports Record IMB 2020 Production, Profits; Applications Down Again in Weekly Survey

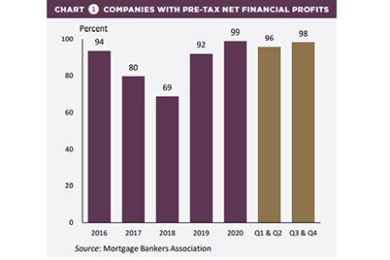

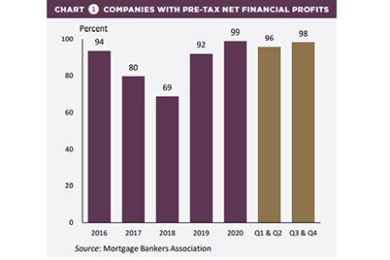

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported this morning.

Mortgage applications again fell across the board from one week earlier, marking the fifth consecutive week of declines, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending April 9.

The Mortgage Bankers Association's grassroots advocacy arm, the Mortgage Action Alliance, issued a Call to Action yesterday, asking its members contact their members of Congress to allow flexibility in implementation of new purchase caps placed on Fannie Mae and Freddie Mac.

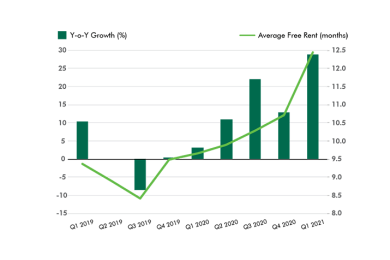

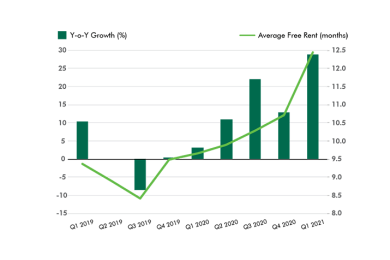

CBRE, Dallas, said the average amount of free rent office landlords conceded to secure long-term leases climbed significantly in the first quarter.

![]()

On behalf of Mortgage Bankers Association Residential Board of Governors (RESBOG) Chair John Hedlund and Vice Chair Al Blank, MBA seeks members’ recommendations for individuals/companies to serve on RESBOG in future terms.

In this article, we’ll discuss how electronic data interchange (EDI) and robotic processing automation (RPA) technology are helping mortgage servicers improve the efficiency of their LPI process.

M&T Realty Capital Corp., Baltimore, closed $70.9 million in multifamily and senior housing transactions in Virginia and Illinois.

The first article of this series addressed the use of behavioral activities as enabling goals. Their purpose: to help LOs who were struggling to reach the production goals to which you and they had agreed. This follow-up piece looks at management’s additional actions to consistently communicate about those observable activity goals.

The mortgage business is inherently transactional and cyclical, with ever-changing rates, high-highs and low-lows, and this trend is not expected to change any time soon. The circumstances due to the pandemic mirror those of the economic downturn in 2008, and in both situations, it was crucial to have formed two-way partnerships with others in the industry who had a vested interest in mutual success and propelling both businesses forward.

Interest in life sciences real estate has jumped during the current public health crisis. MBA NewsLink interviewed JLL Executive Director of U.S. Life Sciences Markets Travis McCready, Managing Director Zach Bowyer and Senior Vice President Erik Hill about the sector.

Jim Cameron is a senior partner with STRATMOR Group, a mortgage advisory firm, where he specializes in benchmarking and performance measurement, strategic planning and managing STRATMOR’s workshop program. He has 30 years of leadership experience in the mortgage industry and was instrumental in working with the MBA to develop the industry-standard benchmarking program known as the MBA and STRATMOR Peer Group Roundtables (“PGR”) Program.

As U.S. housing and real estate markets exceed $36 trillion and operating plans continue to reflect growth, the crumbling of the business-as-usual foundations because of big data and innovation acceleration will lead many banking and lending organizations to make the wrong decisions in 2021 by ignoring their customer value across the supply chain.

Greystone, New York, announced Imran Ahmed joined the firm as a Senior Managing Director, responsible for expanding Greystone’s corporate finance activities, including development of global corporate and investment banking and institutional capital relationships.