BREAKING NEWS

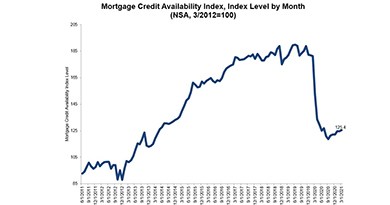

March Mortgage Credit Availability Increases

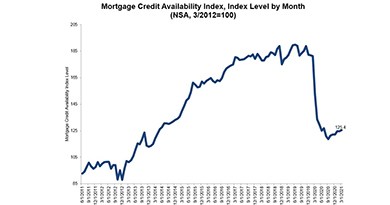

Mortgage credit availability increased in March, the Mortgage Bankers Association reported Thursday.

Seth Appleton, President of MISMO®, issued the following statement in support of Truliant Federal Credit Union’s successful eNote transfer to Federal Home Loan Bank of Atlanta:

The Consumer Financial Protection Bureau on Wednesday proposed extending the effective date of two recent debt collection rules to give affected parties more time to comply due to the ongoing COVID-19 pandemic.

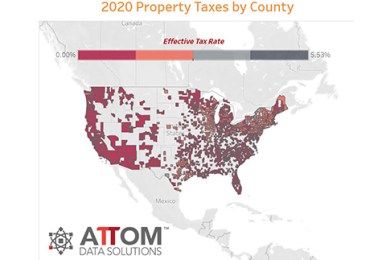

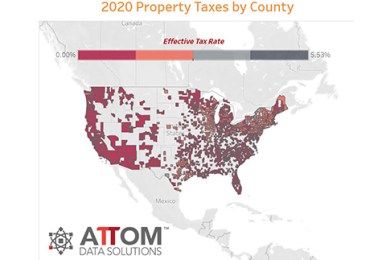

Single-family homeowners saw their property taxes rise on average by 5.4 percent in 2020, to a nationwide total of $323 billion, reported ATTOM Data Solutions, Irvine, Calif.

More renters moved last year than in 2019, and many of them relocated to big cities, reported Yardi Matrix, Santa Barbara, Calif.

When the full effects of the coronavirus pandemic began hitting in March 2020, the Mortgage Bankers Association quickly realized that life as usual—and business as usual—could take a long time to return to “normal.”

Top of Mind Networks, Atlanta, launched a bidirectional data connection between Surefire, its platform for automated mortgage marketing, and Salesforce, an enterprise CRM. The connection gives mortgage lenders choice and control over the way information is shared between their enterprise CRM and mortgage marketing technologies.

Mesa West Capital, Los Angeles, funded $47 million in mezzanine capital to finance commercial real estate transactions in Chicago and San Diego.

As U.S. housing and real estate markets exceed $36 trillion and operating plans continue to reflect growth, the crumbling of the business-as-usual foundations because of big data and innovation acceleration will lead many banking and lending organizations to make the wrong decisions in 2021 by ignoring their customer value across the supply chain.

MISMO’s mission is to develop industry standards to solve real estate finance’s thorniest and most pressing business challenges. To make this happen, we drive collaboration across the mortgage industry and draw participation from all facets of the ecosystem.

Loan officers, branch managers, c-level executives and more need access to granular financial data and in-depth accounting tools in a changing market. The pandemic rapidly spurred the adoption of tech solutions and heightened the industry's reliance on technology – from helping lenders operate, to supporting loan officers in their day-to-day tasks, to increasing daily efficiencies for the accounting department.

Cloud computing allows the mortgage ecosystem to no longer be as segmented but rather, exist in a more holistic environment of insights and solutions that deliver a seamless digital experience. Mortgage professionals are already leveraging cloud technology to make smarter, more informed decisions.

The Mortgage Bankers Association's Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members' recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.