Cities in Western States Expected to Dominate Home Price Increases

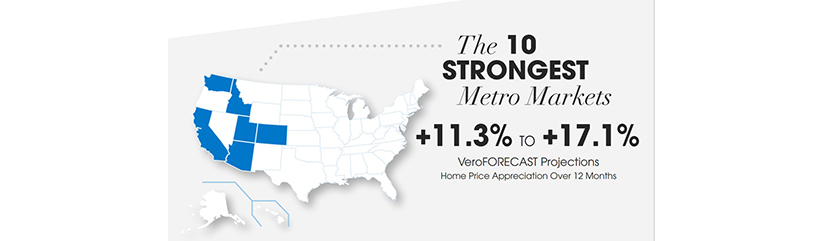

(Graphic courtesy Veros Real Estate Solutions.)

Veros Real Estate Solutions, Santa Ana, Calif., released its Q1 2021 VeroFORECAST data that anticipates home price appreciation will increase significantly during the next 12 months in the 100 most-populated markets.

The forecast said by Q1 2022, the overall average forecast is 7%, an additional increase of 1.1 percentage points compared to 5.9% just a quarter ago. This level of change from one quarter to the next is heavily driven by strong markets, primarily in the West.

“The [data] indicates upward price pressure in nearly all markets during 2021,” said Darius Bozorgi, CEO of Veros Real Estate Solutions. “Buyer demand remains strong with almost no major metro area showing notable home price depreciation over the next 12 months.”

“2021 market conditions will be heavily driven by continued low-interest rates and changes in “working from anywhere” practices that were influenced by the coronavirus pandemic,” said Eric Fox, Veros Vice President of Statistical and Economic Modeling. “Once the global pandemic is largely behind us, interest rates will stabilize and rise to some degree but will remain at historically low levels. At that point, we expect the nationwide market to return to a more typical pattern characterized by regional pockets of strength driven by migration patterns, solid fundamentals in many areas, and weaker markets with slight depreciation in a few others.”

The western portion of the country leads the nation in price increases. Cities in Idaho, Washington, Arizona, Utah, Colorado and California comprise the entirety of the Top 10 metro areas. Appreciation is forecast to continue strengthening with Boise up by 17.1% by Q1 2022. Veros said many of these cities are benefiting from new household formation as migration patterns continue to move around the country.

The list of ten least-performing markets is dominated by cities in Texas, Louisiana and Illinois. The two markets that will see the slowest growth are forecast to be in Texas oil country – Odessa and Midland. However, they are predicted to appreciate at 1% or 2%.