BREAKING NEWS

MBA Builder Applications Survey Reports Strong Monthly, Annual Growth

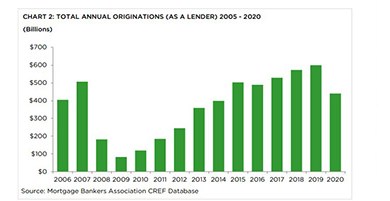

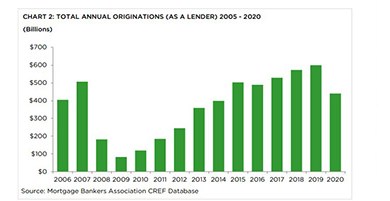

Commercial and multifamily mortgage bankers closed $441.5 billion in loans in 2020, the Mortgage Bankers Association’s 2020 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation reported, nearly 26 percent lower than the record $601 billion reported in 2019.

The Mortgage Bankers Association’s Builder Applications Survey for March reported mortgage applications for new home purchases increased by 7 percent from a year ago. and by 12 percent from February.

Beware the Ides of April—unless it’s news you seek. Because we have plenty of housing market reports below to slake your thirst.

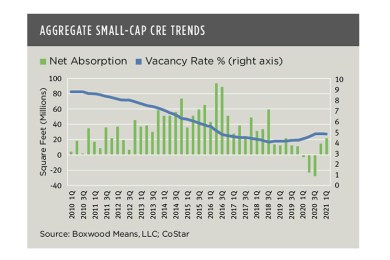

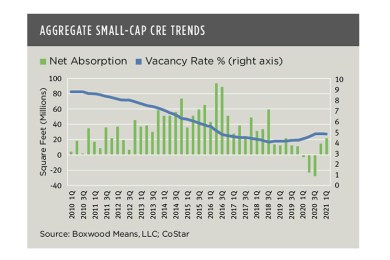

Boxwood Means LLC, Stamford, Conn., said leasing in the small-cap real estate domain showed strong momentum during the first quarter as the economy bounced back from the pandemic.

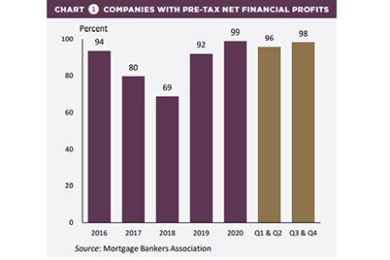

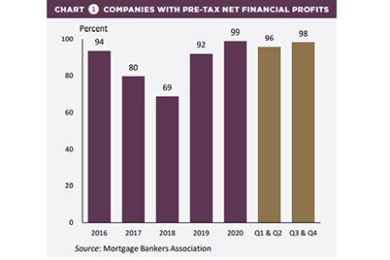

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported Wednesday

In this article, we’ll discuss how electronic data interchange (EDI) and robotic processing automation (RPA) technology are helping mortgage servicers improve the efficiency of their LPI process.

Newmark, New York, closed life science property sales totaling $137.2 million in Massachusetts and California.

Given the necessary delay that must precede the analysis of post-closing data, it is easy to forget the significance of these findings. However, mistakes made in the past often do not remain so, especially when those mistakes go unaddressed. Thus, lenders have a great deal to learn from their post-closing quality control analyses, even more so given the market disruptions and macroeconomic impact of COVID-19.

The first article of this series addressed the use of behavioral activities as enabling goals. Their purpose: to help LOs who were struggling to reach the production goals to which you and they had agreed. This follow-up piece looks at management’s additional actions to consistently communicate about those observable activity goals.

The mortgage business is inherently transactional and cyclical, with ever-changing rates, high-highs and low-lows, and this trend is not expected to change any time soon. The circumstances due to the pandemic mirror those of the economic downturn in 2008, and in both situations, it was crucial to have formed two-way partnerships with others in the industry who had a vested interest in mutual success and propelling both businesses forward.

Interest in life sciences real estate has jumped during the current public health crisis. MBA NewsLink interviewed JLL Executive Director of U.S. Life Sciences Markets Travis McCready, Managing Director Zach Bowyer and Senior Vice President Erik Hill about the sector.

Jim Cameron is a senior partner with STRATMOR Group, a mortgage advisory firm, where he specializes in benchmarking and performance measurement, strategic planning and managing STRATMOR’s workshop program. He has 30 years of leadership experience in the mortgage industry and was instrumental in working with the MBA to develop the industry-standard benchmarking program known as the MBA and STRATMOR Peer Group Roundtables (“PGR”) Program.

The Mortgage Bankers Association’s Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members’ recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.