BREAKING NEWS

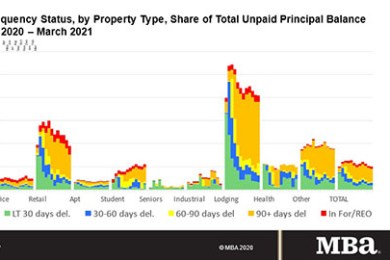

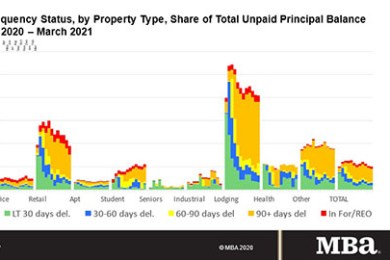

Commercial/Multifamily Delinquencies Fall for 3rd Straight Month

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in March, reaching the lowest level since the onset of the COVID-19 pandemic, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

Pending home sales fell for the second straight month in February, the National Association of Realtors reported yesterday. Each of the four major U.S. regions witnessed month-over-month declines in February, while results were mixed in the four regions year-over-year.

Two reports—from ATTOM Data Solutions, Irvine, Calif., and First American Financial Corp., Santa Ana, Calif.—say despite sharp spikes in home prices, homeownership remains affordable for most workers, which continues to drive housing demand.

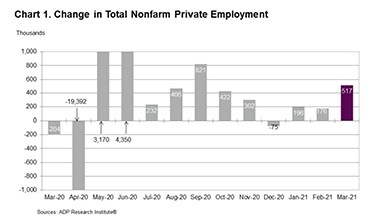

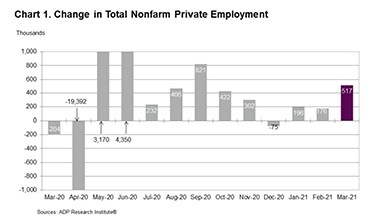

Ahead of this morning’s initial claims report from the Labor Department and Friday’s jobs report from the Bureau of Labor Statistics, ADP, Roseland, N.J., said private-sector employment jumped by 517,000 jobs from February to March.

NAMMBA Consulting and Cultural Outreach have partnered to conduct the first annual holistic report of diversity for positions across the entirety of the mortgage industry.

CBRE arranged $54 million for an industrial property and a multifamily property in metropolitan San Diego.

Does your company have a process of activities that, when followed, significantly increases a motivated LOs likelihood of success? Well, if your company is like most in this industry, you know the answer to that question.

The domino effect – an endless run of falling dominos winding through the residential home construction industry. That's a vision we can easily conjure up when witnessing the ongoing impacts of steadily rising construction costs. And guess who is at the end of the domino chain, having to deal with the residual mess? Residential home appraisers and their lender clients.

Auction.com, Irvine, Calif., promoted Ali Haralson to president, a new position in the company that will oversee both sales and operations.

The Mortgage Bankers Association's young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

MISMO, the industry’s standards organization, developed iLAD through close collaboration across the industry, including with lenders, vendors, IT companies and GSEs. The MISMO Loan Application Data Exchange (LADE) Development Work Group is working to ensure these iLAD specifications will continue to evolve to meet industry needs.