Trepp: 4Q Bank CRE Loan Data Show ‘Elevated Distress’

(Chart courtesy of Trepp LLC.)

The U.S. economy is well into its recovery from the pandemic recession, but Trepp LLC, New York, noted bank commercial real estate loans indicated “elevated distress” in the fourth quarter.

“The fourth quarter of 2020 was the precursor to an economic recovery that will continue into the next several years,” said Trepp Research Analyst Maximillian Nelson in a new report, Despite Beginnings of Recovery, Q4 Bank CRE Loan Data Shows Elevated Distress. “The extraordinary circumstances of 2020 ended with an election, wider-spread access to vaccines and increases in economic relief.”

Nelson examined data from Trepp’s Anonymized Loan Level Repository to view commercial real estate’s general health through the lens of bank repository loans. It found growing distress in the market.

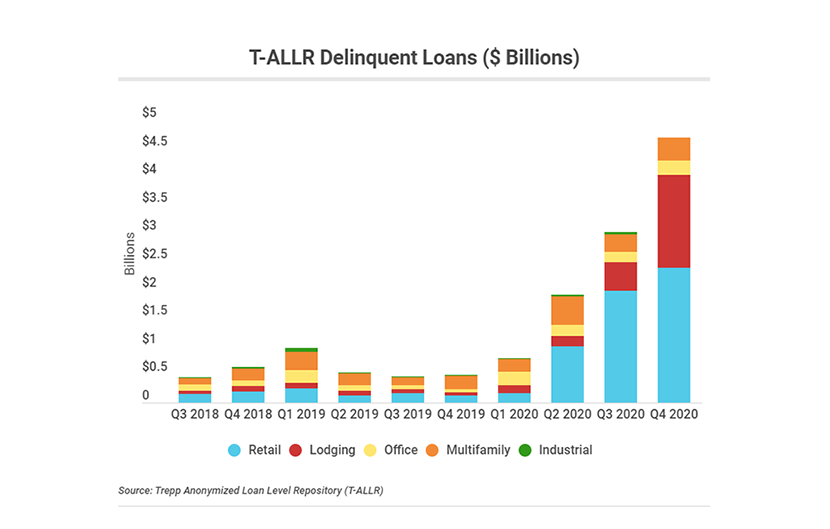

“The balance of delinquent or non-current loans has continued to rise, with the lodging sector seeing the largest increase in the balance of delinquency loans among the commonly tracked CRE property types during Q4 2020,” the report said. The lodging sector’s delinquent loan balance increased to $1.64 billion, compared to less than $500 million in the third quarter.

The total outstanding delinquent balance rose to $4.67 billion in late 2020 from just over $3 billion in the third quarter, driven by increasing delinquent loans backed by retail, lodging and office properties, Trepp found. “While distress percentages among bank loans are still lower than that of the commercial mortgage-backed securities universe, the number of loans that are delinquent increased for the fourth quarter in a row,” the report said.

By property type, delinquencies are concentrated mostly in the lodging and retail sectors, as delinquency rates increased to 11.6 percent and 6.1 percent, respectively, for those two property types in the fourth quarter.

Looking at origination volume, Trepp said market volatility is settling down and market players are increasing their lending activity. “The volume of bank-backed commercial real estate loan originations rose in Q4 2020 after dropping to less than half of its volume the year prior in Q3 2020,” the report said. It noted banks originated more than $6.4 billion in loans during the fourth quarter, the highest amount since first-quarter 2020 and a $1.7 billion jump from the third.

“Continued rises in origination volume point the commercial real estate environment in a more positive position, and as investor confidence returns to the market, it is likely we will continue to see a trend in bank loans like that in the CMBS universe, where loans that are delinquent or with the special servicer have begun to cure,” the report said.