BREAKING NEWS

MBA: August Builder Applications Up 33% From Year Ago; Down 4% From July

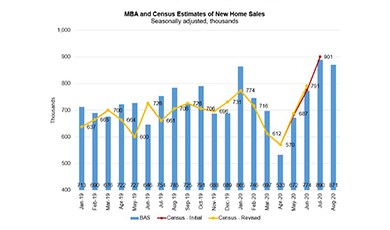

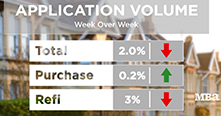

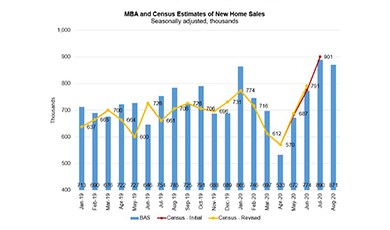

August mortgage applications for new home purchases increased by 33.3 percent from a year ago but fell by 4 percent from July, the Mortgage Bankers Association reported this morning.

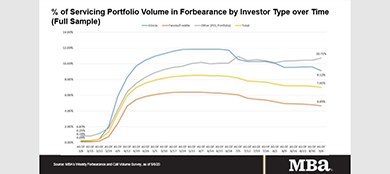

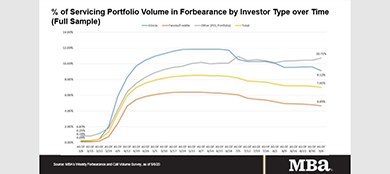

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 15 basis points last week to 7.01% of mortgage servicers’ portfolio volume as of Sept. 6, down from 7.16% the previous week. According to MBA estimates 3.5 million homeowners are in forbearance plans.

Here’s a roundup of recent housing finance market reports, from Black Knight, Fannie Mae and Redfin.

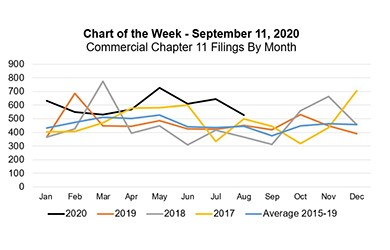

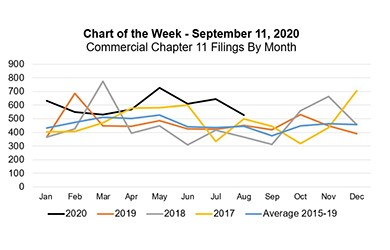

As the U.S. economy works its way through the current pandemic and recession, housing has been a clear bright spot in an otherwise dire time. This week’s chart highlights the “V” shaped recovery exhibited by various measures of housing health.

Roostify, San Francisco, named Chris Boyle President of Home Lending, responsible for all external-facing functions, client engagement, strategy, marketing and business development.

Join us online for the MBA Annual Convention & Expo 2020. We're bringing the most anticipated industry event of the year directly to your house.

In this industry, as part of the lender due diligence process, the financials and credit history of every mortgage banking customer are combed over and scrutinized. Mortgage banks search for any and every detail to properly assess the probability of loan repayment. However, when it comes to their own financials, not all lenders give as much consideration to the details as others.

Last Wednesday kicked off the California Mortgage Bankers Association’s 23rd Annual Western States CREF, this year the conference was delivered as a two-day virtual experience on September 9 and 10.

Last week SimpleNexus, Lehi, Utah, named Cathleen Schreiner Gates as its new President, responsible for all operations and business strategy. MBA NewsLink talked with her about her new role and the state of the mortgage industry.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

With Congress (most notably the Senate) unable to reach consensus on the passage of any additional COVID-related economic relief, MBA sent a letter last Tuesday to the CFPB responding to the Bureau’s proposed rule revising the General QM definition. The letter explains MBA’s support for the price-based QM construct, and offers several recommendations to help ensure the rule meets its stated goals of robust consumer protections and broad access to sustainable credit.

M&T Realty Capital Corp., Baltimore, closed $123.9 million in Fannie Mae and Freddie Mac multifamily loans.