Mark P. Dangelo: Beyond Digital Transformation, Part 3—Preparing for the M&As of 2021

Financial services and banking organizational products and services comprehensively live in a world of digital focused by time, driven by analytics, compelled by volumes, and determined by consumers. As FSBOs seek road maps to remain relevant in an age of digital and non-traditional competitors, they must accept that to be a survivor during this next year and the ensuing decade the entry fee for future consumer adoption (e.g., Millennials and Gen Z) are integrated and robust solution sets.

A Misplaced Bravado

Yet how many FSBOs believe that they lead or even dominate their competition when it comes to financial services digital experiences and cross-linked solutions? “Are you talking about digitization, we’ve already done that and spent a lot of money getting there.” This acceptance of their strengths due to the amount of money spent, will expose these miscalculations allowing others to integrate “tuck-in” (i.e., a net add to the acquirer) and/or “absorb” (i.e., acquire customers and accounts) actions due to the digital leverage built since 2017 by FSBO innovation leadership teams. It is not a coincidence that these teams defined and increased their core competencies with what has been defined as the beginning of the “Fourth Industrial Revolution.”

Looking forward, what are the FSBO budget allocations in an industry experiencing an IT decline of 8% to 10% in 2020 when it comes to emerging innovation adoption? Looking later into 2021, for those organizations that excelled with their leverage of everything digital, will they be satisfied with organic growth and their in-house or partner innovation solutions? Alternatively, will they go on the hunt to bolster their customer base by conducting M&A “enveloping” actions? Will the M&A mantra of “merger of equals” combine leading digital firms into a larger, disruptive innovative FSBO?

And, there’s growing realization that once the election results have been tabulated and made official, the reprieve from FSBO regulatory compliance demands may negatively transform operating necessities against an economic and employment situation that the Federal Reserve Chair has indicated may stretch till 2025. If automation and artificial intelligence continues it non-linear acceleration, then only those institutions who have invested in digital leverage using innovation layering, will be in a position to not only grow, but scale using proven M&A methods such as “roll-ups” and “carve-outs” to achieve post-deal synergies.

A by-product of FSBOs seeking efficiencies is that after initial retrenchment followed by a strategic reassessment underpinned against altered key performance measures, what will be the transparent alternatives for growth—what is possible? While mortgage lenders have enjoyed a euphoric year, the challenge for many lacking the LOB diversification, investor depth, or innovation leadership will be how to rise to the demand for digital leverage as a M&A enabler (i.e., acquire or be acquired). Furthermore, cornerstone challenges across FSBOs not accustom to innovation disruption M&A events will be with the creation of the roadmaps, securing the advanced skills, executing against the tactical and strategic needs, adjusting cultures and governance and orchestrating layers of options and building blocks in a post-deal organization.

Events of 2020 Likely to Facilitate Industry Marriages

The growth banks have booked since 2008 has been historical not only in terms of causality risk mitigation strategies, but in the tens of billions in profits booked quarter after quarter. However, the number of banks in 2008 was just under 12,000 in the U.S.—today that number is scarcely over 5,000 as the total asset base across institutions nearly exceeds $20 trillion. The U.S. Central Bank since March in total has injected, purchased, repoed, or generated over $9 trillion in monetary stimulus—by some estimates eclipsing over two centuries of USD creation. It remains to be seen if the conclusion of 2020 ushers in a waterfall decade for risks, inflation and stagnant interest rates all impacting margins and lending tradition with unintended consequences.

Within the FSBOs themselves cracks in operating models and profits have been exposed with the arrival of the pandemic—lines of business (LOB) such as residential mortgage lending experiencing the greatest quarter (Q2) in history (>$1.2 T in originations), while others set aside tens of billions in loan loss reserves severely impacting net income by over $80 billion compared to a year earlier. Q3 profit deficits from the prior year may decline in aggregate by over $100 billion. With FSBO profits severely hit because of Covid-19 responses and uncertain economic conditions, many forward-looking leadership teams are turning to deliver operating efficiencies, cut risk exposures, and cull personnel deemed too expensive or having marginal contributions as part of an industry realignment in a WFH (work from home) world.

Additionally, starting in 2021, several large sovereign cybercurrencies (based on variations of blockchain and DLT) will launch globally adding to the first one (termed CBDCs, central bank digital currencies), which launched this month (i.e., Bahamas). Each sovereign implementation will come with unique compliance and government requirements, in what has been defined as a comprehensive digital tracing of funds under the auspices of KYC—”controllable anonymity.”

The CBDC technology implications needed to validate, trace deposits, and consumer purchases may be getting much more granular and the technology sophistication demanding financial innovation out of the reach for all but the largest of institutions. In short, the multi-faceted financial supply chains, of which mortgage lending is just a part, is becoming tightly-coupled and comprehensively digital escalating the volumes of data, the regulatory burdens, and vast detail of personal profiles for every banking customer (with paper money retreating even further to <5%) regardless of FSBO size or segment served.

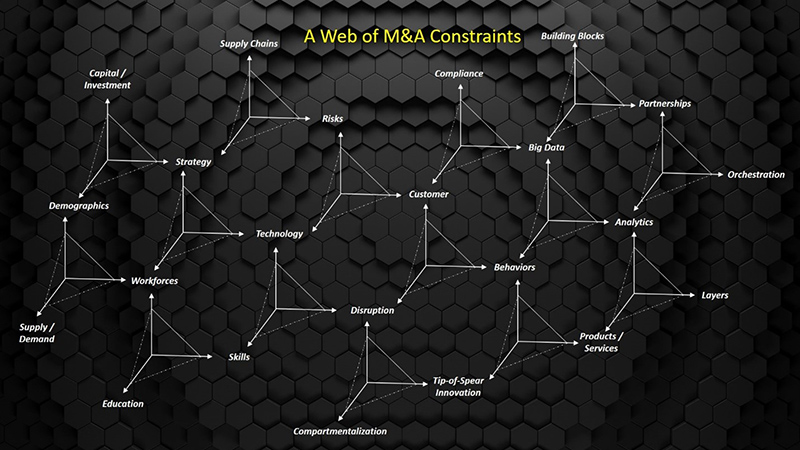

As FSBOs adapt, the rush to incorporate capabilities and technologies to prepare for what the future holds, the constraints of governance, operations, deliver and innovation will map into a digital web that astute leaders will recognize. An illustration of interconnected M&A constraints is presented below:

As 2021 dawns, it also may witness a resurgence of larger, well capitalized FSBOs seeking out others industry players with strong digital leverage solution sets to invoke a post-deal M&A refresh of the systems and processes. Digital transformation was the great equalizer prior to 2019, but in a new reality of stay at home and Covid-19 events, we can now begin to witness it is the value of digital leverage that will disrupt FSBOs in the coming decade.

The Mask of Today’s Digital and Cyber Complexities

The challenges now facing FSBOs, and their discrete operations such as mortgage and consumer lending, are building especially as economic pressures remain during an unprecedented global health crisis. These pressures—technology investment, portfolio risks, consumer shifts, data volumes, cyber security, financial instruments, digital leverage—represent trends that were nascent or underway prior to Q1 2020.

However, what has become apparent is that the strategies and solution sets deployed up to this decade may not be transferable with FSBOs seeking relevancy as we approach 2021. The idea that FSBOs must find relevancy the future when their recovery since the Great Recession has been historic seems counterintuitive. Yet, when we look at the consumer and the system of record for their financial health and transactions, FSBOs now control under 35% of these informational assets down from over 75% back in 2006.

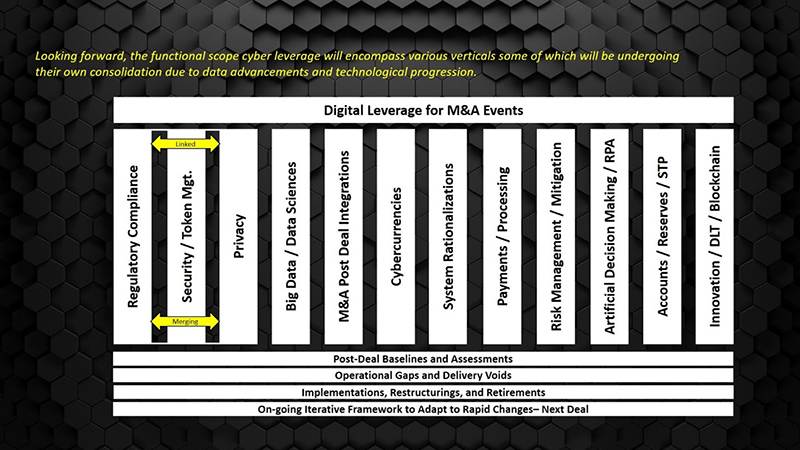

Oracle prior to the pandemic stated, “Most Banks will be made irrelevant by 2030” with “80% of financial firms” out of business or competitively swallowed. We are nine years away, and if even part of this prediction proves accurate, the traditional industry may experience a loss of over 1.3 million jobs accelerating reskilling demands and a loss of prestige and political value. Why might this be possible as an outcome? In the diagram below, a list of a few of the dozens of functional core competencies and implications that face not only the discrete FSBO, but the post-deal integrations that impact every M&A event launched in this coming decade.

As consumers move to 100% digital, entities such as neobanks which have no physical footprint, gain marketshare in an age of financial commoditization and shrinking regulations bridged by innovational disruption. Moreover, as traditional branch closures accelerate (losing over 15,000 since 2008) due to uncompromising legacy investments, consumer engagement, and IT strategy, should banks which have the intellect and experience be leading the disruptive transformation—or will M&A events led by technology-financial firms telegraph a rush for customer absorptions?

The shock of the past seven months has placed the challenges into context as the trends existing prior to Covid-19 has been made visible and rapidly accelerated. The advancements in digitization and the capital investments made by FSBOs will not abate—these investments were just the opening act necessary to compete.

Moving forward, perhaps it is a confluence of factors that converge across the investments made in technologies which will require additional, significant expenditure in professional reskilling, the leveraging of digital, and a rapid iterative delivery structure based on orchestration? As banker’s and their technology adaptation drive new business models, is the funding of innovation disruption firms (e.g., fintech) laying the seeds for their own obsolescence from traditional, commodity delivered products and services (e.g., approvals, lending, credit ratings)?

This digital leverage series has provided the foundational information and initial questions that face financial institutions—but it just the start. As industry participants of varied backgrounds, we are looking forward trying to deal with uncertainty and chaos against unprecedented fiscal and monetary guidance. It now appears that the to capitalize on the trends, consumer demands and competitive realities, digital leverage will be a core competency to disrupt and survive the digitally complex M&As.

M&A Digital Leverage—Beyond the ETL, Port and Lift-and-Shift

Unprecedented tip-of-spear innovation has accelerated since 2017, created from the final cycles of Moore’s Law, forcing many corporate leaders to adjust the spend on FSBO IT just as customer behaviors and cyber risks are in flux. Looking forward while creating a sense of urgency to transform and adapt, consumers consistently view FSBOs in the bottom third of business value propositions and customer service rankings. After billions spent on IT services, products, and consultants, have these capital investments been worth the implementations, delays, security and privacy challenges?

What the M&A trends are highlighting is that the ecosystems, which exist within and across the FSBO supply chains, will continue to be influenced by cyber (e.g., IT, digitalization) and data advancements linked to consumer and economic transformations. We have expanded beyond monolithic, flat IT solutions into layered ones using emerging data sciences and technologies. Moreover, digital transformation using advancing cyber solution sets is no longer something we do because we are in a FSBO and it helps our efficiencies and quality. Being digital and integrated across our enterprise is mandated by consumers seeking value-added benefits to aid their lives—not what they “should have” given the state of FSBO infrastructure.

If we were to review and plan our M&A cyber and digital leverage strategies for the future, where would we even start? Has the profitability of a few LOB’s masked unattributed risks due to a digital swagger that “we got this”? Do these cyber and digital buy-in technologies represent the beginning of the “next, next normal” for lenders and securitizing agencies as part of the due diligence “bundled” with every loan? Is Covid-19 the primary shift for consumer and business investment changes as some M&A strategists infer? Is the underlying rationale for the looming M&A post-deal integration shifts attributed to a once-in-a-hundred-year event, or if we examined the data points across the complex FSBO supply chains would we conclude different forces in play?

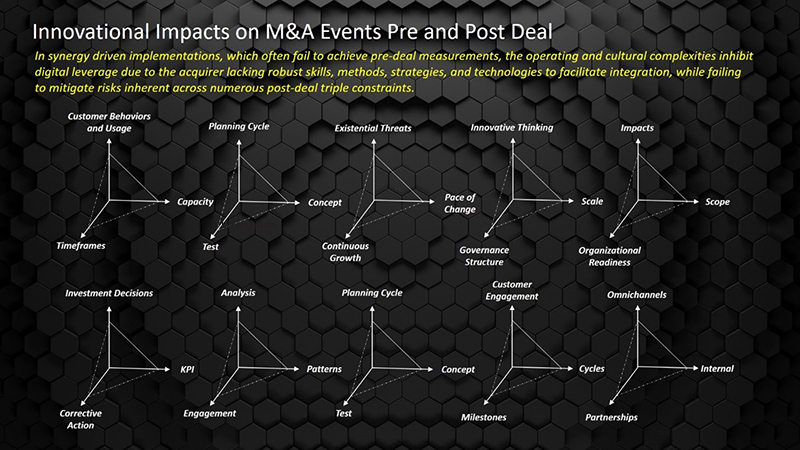

Finally, when it comes to M&A cyber innovations today—process, technology, data, summarization, analytical, cash and currency, payments, security, privacy, compliance, synthetic intelligence—would we subscribe to anything but layers of integrated digital and cyber solutions if given alternative choices? To help frame your answers, we need to look at the building web of M&A innovational impacts on pre- and post-deal events and their integration to the prior diagram of interconnected web of constraints and tradeoffs.

The world of M&A driven cyber innovation is now moving to meet its surrounding external environmental using digital leverage as the method to gain success. Consumers and enterprises that use your products and services expect that those whom they partner with, spend time and money with, and share their trust and thought capital with, also move in their environmental timeframes and reactionary pressures. FSBOs will have to adapt. Moving forward utilizing advancing, iterative cyber and data solutions requires that as industry leaders, the questions asked are as equally important and the prescriptive answers given to retain consumer relevancy.

As we reach the end of our series on digital leverage, we can understand the shifts necessary to move from a digital order-taking, check-the-box FSBO implementation towards an approach that layers and compartmentalizes innovational advancements. To participate in consumer’s financial needs, FSBOs cannot hope for a return to traditional processes, access and branch models. Digital leverage, comprehensive implementation across all forms of the digital financial supply chains, has found the defining year to usher in contactless banking. The future value proposition of digital solutions and vast financial ecosystems are escalating, creating chasms of opportunities that FSBO’s must capitalize on against nimble competitors who are leveraging their investments in data, technology and personnel.

In the end, M&A digital leverage will become the currency of the FSBO realm—a great equalizer for FSBO’s who capitalize on the advancements to deliver efficiencies, create building blocks, and innovate in layers. These digitally leveraged FSBOs will be ones who will be one of the 2,000 to 2,500 institutions left by 2030—the others who “got it” will be footnotes in history.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)