BREAKING NEWS

MBA: Loans in Forbearance Drop to 5.9%

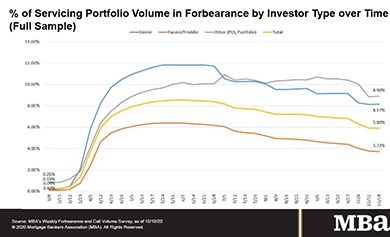

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

September new home sales fell for the first time in five months, HUD and the Census Bureau reported yesterday.

![]()

How companies and their workforces will use office going forward is an increasingly popular subject in 2020. There are questions around existing buildings and how landlord business plans and those of their lenders will perform.

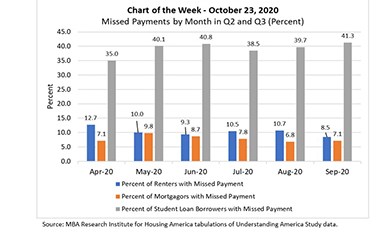

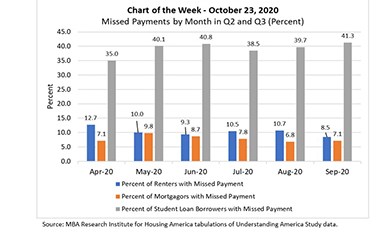

This week’s MBA Chart of the Week chart provides fresh third quarter 2020 insights on the Research Institute for Housing America’s special report released in September that highlighted household financial distress during the second quarter—the first three months of the pandemic.

ServiceLink’s Ryan Helms, product manager, explains how new technology is poised to help servicers and investors make better decisions on how to manage their default portfolios.

In early October I surveyed 33 senior executives from 33 separate mortgage companies about a wide array of issues and topics both germane and important to the mortgage banking industry. It was the 24th time such a survey was conducted by me since 2008.

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

Banking and lending organizations with superior digital assets will create disruptive customer experiences and insights. They will be the sharks seeking the distressed institutions as 2021 arrives. Digital leverage has become a currency for innovative firms seeking larger markets, margins, and non-organic growth multipliers made singularly possible by their post-deal integrations skills and capabilities.

Overlooking this factor when choosing an eClosing technology service provider could cost you.

STRATMOR Group, Greenwood Village, Colo., announced that company principal Seth Sprague, CMB, has been named chairperson of the Mortgage Bankers Association's Certified Mortgage Banker (CMB®) Society for the 2020-2021 year.

Stewart Appraisals Management Inc., Houston, announced its acquisition of Pro-Teck Services Ltd., DBA Pro Teck Valuation Intelligence.

NorthMarq, Minneapolis, secured $104.8 million for multifamily properties in California and Florida.