Brian Zitin: Foreshadowing Future Appraisal Bottlenecks During Covid-19

Brian Zitin is co-founder and CEO of Reggora, Boston, a venture-backed startup that provides software to speed up the appraisal process for mortgage lenders and real estate appraisers. Prior to Reggora, he co-founded a real estate brokerage called Sonder Partners, which was based on a proprietary algorithm that helped to efficiently target and sell investment properties in the Greater Boston area. His time with Sonder Partners exposed him to inefficiencies in the modern appraisal process, which led to the start of Reggora. He has also spent time at both a boutique private equity company and a large commercial real estate investment firm.

It goes without saying that the recent activity in the mortgage industry has been historic. Lenders are seeing record-breaking volume month over month, and it doesn’t seem to be slowing down.

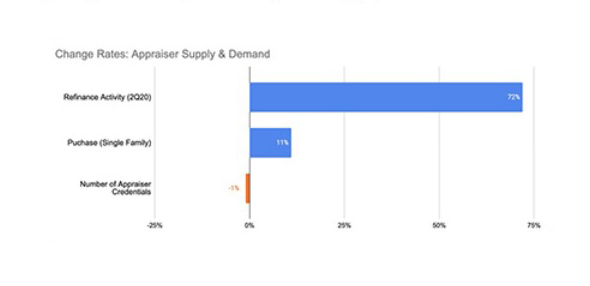

One thing that has slowed down across the industry, however, is appraisal turn times. As the volume of loans requiring appraisals goes up, the number of appraisers seems to be going in the opposite direction. Here’s an interesting graph illustrating the year-over-year change of supply and demand factors from published sources:

Freddie Mac shows projected mortgage refinance activity increasing 72% in 2Q20; the National Association of Realtors shows single family purchase activity up 11% in August 2020, and data derived from both the Appraisal Subcommittee and Appraisal Institute show a 1% decline in the ranks of appraisers holding a licensing credential comparing (2018 vs 2020).

One can see that the number of active appraisers has slightly declined, while the number of transactions requiring appraisals for both new home loans and refinances has increased. Just like wait times for your Uber will surge when it’s raining, wait times for appraisers is causing appraisal turn times to surge as well. What this means is that although lenders have larger pipelines of loans, those loans are experiencing bottlenecks due to appraisal cycle times. This impacts efficiency, profitability, borrower experience and more for mortgage lenders.

Unlike a rainy day with Uber, however, where more Uber drivers can easily be on-boarded and hit the streets and commuters have the option of taking the subway or a bus instead, it’s not nearly as easy to increase the ranks with new appraisers, and there are very few alternatives to the lender or consumer for lending products that do not require an appraisal. While some headway has been made in reducing the need for appraisals with a full interior inspection and some activity is occurring in the space of appraisal waivers, there are no broad alternative options available for a majority of transactions that require an appraisal—the appraisal must be completed in order for the loan to be issued.

What we’re looking at here is both a logistics challenge (how can we utilize the current supply of appraisers more efficiently?) and a systemic challenge (how can we make it easier for new appraisers to enter the market, and how can the marketplace risk-appropriately reduce the need for an appraisal?). Until the system improves, we will continue to see appraisal bottlenecks that prevent the industry from flourishing, far beyond the era of Covid-19.

Much of this falls to the secondary market (GSEs and others) to address. Although the GSEs have tried to alleviate the strain through modern programs like appraisal waivers, and other modernization initiatives, because there needs to be balance to the risk of credit default, these programs can only offer relief on a limited percentage of loans.

Let’s take a closer look at the appraiser supply issue.

Industry groups have long talked about the average age of the appraiser as being over 60 years old and rising. An overwhelming majority of appraisers in the marketplace are over the age of 50. While the ranks of new appraisers have ticked up in recent years, they are not enough to offset those exiting the marketplace. Barriers to entry including stringent licensing requirements, and compensation for trainees and minimally credentialed appraisers (i.e. license). Although there have been efforts by the various appraisal industry stakeholders to bolster the entry of new appraisers into the field, this has largely been unsuccessful when looking at the actual numbers.

So as the average appraiser approaches retirement in the coming years and decides to leave the industry, the number of active appraisers will continue to decline. The supply/demand imbalance is anticipated to get progressively worse, even if loan volumes plateau in the future.

What’s the solution?

Appraisal is the one unique aspect of the mortgage application process that better software alone can’t solve, because there is a physical component to it that takes place in the real world, as well as requirement for a granular level of judgment that many believe cannot be replicated by machine learning. Therefore, if the industry actually wants to progress instead of regress, two things need to happen:

- We need to improve the logistics around managing and distributing all of the appraisal orders, so that the existing supply of appraisers can actually accommodate demand without persistent workflow problems. This will help shovel the water out of the boat, so to speak.

- In order to officially plug the holes, there needs to be change that leads to an increase in the supply of people able to appraise/inspect properties, or significant disruptions in the marketplace to either increase capacity through productivity gains or reduce the need for valuations by credentialed appraisers.

Reggora is actively working on #1 and we think the future will look similar to an “Uber-style” ecosystem, versus a local taxi dispatch version of it, with much improved logistics.

In regards to #2 however, alignment across the industry will be key. With secondary market investors, federal laws and regulations, and industry organizations all dictating the standards and risk tolerances when it comes to what can and cannot be done as it relates to real estate lending and appraisals/valuations, a more urgent alignment of these stakeholders is needed. In order to allow the industry to fully meet growing consumer and organizational expectations for increased efficiency and proficiency, paving the way for true modernization and optimization of the decision-making process, the standards around valuation need to be redefined.

What would these new standards look like?

As conventional efforts to increase the supply of appraisers have not been overly effective, we should look to a new version of valuation that maintains an appropriate level of risk management, but allows for more workers in the market with fewer barriers to entry when it comes to who is conducting the details on the property pledged as collateral.

Meaning on a spectrum of loans with various risk levels, could a gig-economy style inspector be the one completing an inspection who then sends that information to an appraiser at their desktop to complete a valuation for some types of loans? One could imagine a world where the Texas ranch style dwelling on a 5,000 SF lot, which has 20 near-identical comparable sales which have all sold recently, wouldn’t need the same level of collateral underwriting scrutiny as a lakeside property in rural Maine—in which case an actual appraiser would be dispatched.

If true, then there’s a possibility that we can increase the supply of field vendors able to complete inspections by standardizing the inspection component and making it accessible to a lower threshold of expertise. This would require the help of technology (like a mobile app with fraud detection, computer vision, etc.) in order to maintain a high level of fidelity around the property data collection process.

How can we make it happen?

It will be important for the GSEs, secondary market investors and others to align on a north star. Once everyone agrees on what they are comfortable with from an underwriting standpoint and where to balance risk and reward, then the entire industry can move in the right direction.

First, the industry should establish new underwriting standards for valuation requirements and goals to unlock barriers to entry for new appraisers. Concurrently, technology companies such as Reggora can drive innovation leveraging automation and intelligence to optimize order placement and delivery logistics, making it appealing for current day stakeholders to engage. Then, as an industry, we can begin to aggregate enough data around whether these new standards are successful. If so, then we can scalably roll out more substantial changes which will ultimately lead to better outcomes for everyone involved

There’s a lot more to dig into on this road map, so watch for a deeper dive in the future. In the meantime, I welcome all feedback and discussion on this topic while we help to drive appraisal innovation across the industry.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)