BREAKING NEWS

RIHA Study Shows Renters, Mortgage Borrowers Struggled in September

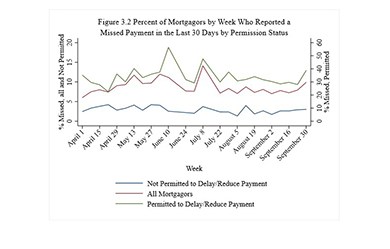

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association's Research Institute for Housing America.

MISMO®, the mortgage industry's standards organization, today announced that its widely adopted MISMO 3.4 Reference Model has been upgraded to “Recommendation” status. This status is the highest possible maturity level that can be bestowed on a MISMO standard.

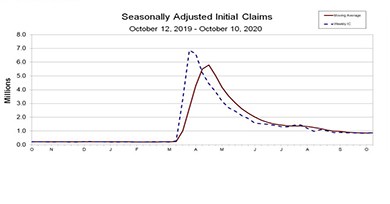

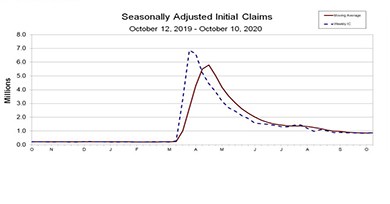

The labor market remains under stress, as evidenced by yesterday’s initial claims report from the Labor Department, which showed claims rising for the second straight week to its highest level since August.

The pandemic is accelerating many existing real estate trends and spawning some new ones, PwC and The Urban Land Institute said in their Emerging Trends in Real Estate 2021 report.

The Mortgage Bankers Association’s Builder Applications Survey data for September shows mortgage applications for new home purchases increased by 38.2 percent from a year ago, unadjusted, but fell by 5 percent from August.

We focused on the importance of pricing along the customer journey: during the hunt for a loan, when comparing lenders before completing an application, and (given the ease of comparing prices online these days) whether consumers continue to shop once their application is underway. From this, we identified five insights that will guide lenders as they evolve and enhance their pricing capabilities.

The Mortgage Bankers Association's first-ever virtual Annual Convention & Expo is just around the corner, beginning this Monday, Oct. 19 and running through Wednesday, Oct. 21.

What ever happened to Senate Bill 3533, the Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020 (the “SECURE Act”), bipartisan legislation to authorize and establish minimum standards for electronic and remote notarizations (RON), which was introduced in mid-March? We assert that this question would be on more lips and in more headlines had not nearly every state in the Union either adopted its own version of the law or enacted pandemic-necessitated workarounds.

Lenders are seeing record-breaking volume month over month, and it doesn’t seem to be slowing down. One thing that has slowed down across the industry, however, is appraisal turn times. As the volume of loans requiring appraisals goes up, the number of appraisers seems to be going in the opposite direction.

With eClosings on the rise and remote online eClosings in demand during the COVID-19 pandemic, many lenders and settlement providers are eager to extend these services to their customers. There are many important factors to consider when selecting an eClosing technology service provider.

Cristy and I sat down on October 13th and discussed the current state of the market and the trends we are observing in default management servicing.

With more than 900 lawyers across 17 offices, Seyfarth Shaw LLP provides transactional, advisory and litigation legal services to clients worldwide.

Fantini & Gorga, Boston, secured $17.3 million for multifamily, mixed-use and retail assets in New Hampshire and New York.