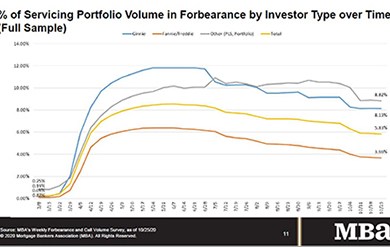

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

![]()

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

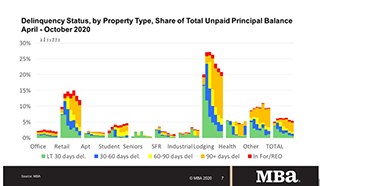

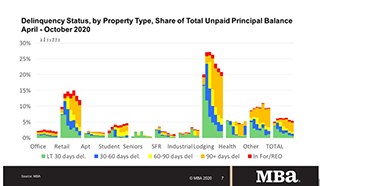

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

MISMO, the mortgage industry's standards organization, released its new MISMO API (application programming interface) Toolkit yesterday for a 60-day member comment period.

Lenders face considerable challenges managing their in-house panels in the current mortgage environment. AMCs offer solutions.

Tech industry job loss has been minimal during the pandemic, and the tech sector is still driving U.S. office-leasing activity, reported CBRE, Los Angeles.

News in brief from SimpleNexus, Black Knight, the Consumer Financial Protection Bureau and TovoData.

Kennedy Wilson, Beverly Hills, Calif., acquired 880 units across three multifamily properties in a $198 million off-market transaction.

Paul Anselmo is CEO and founder of Evolve Mortgage Services and SigniaDocuments Inc, a provider of outsourced mortgage platforms. He has more than 30 years of experience in the banking and mortgage industries.

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).

On Wednesday, HUD extended FHA’s appraisal and reverification of employment flexibilities through December 31. On Tuesday, MBA submitted comments in response to the proposed interagency flood insurance Q&A jointly issued by the OCC, the Federal Reserve, FDIC, NCUA and FCA. Also on Tuesday, MBA issued a call to action to MAA members in Pennsylvania urging Gov. Tom Wolf to approve legislation (HB 2370) that would permanently enable the use of RON in the state.

This week’s chart compares the 2008-2010 Great Recession (left), to the recent pandemic-driven recession (right), to illustrate the differences in consumer spending and in both nonresidential and residential investment.