BREAKING NEWS

MBA: Share of Loans in Forbearance Falls to 5.47%; Seth Appleton on the Future of MISMO

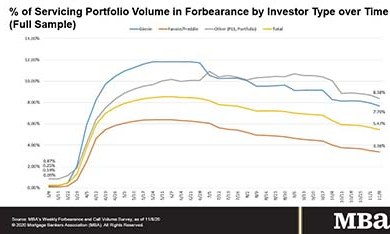

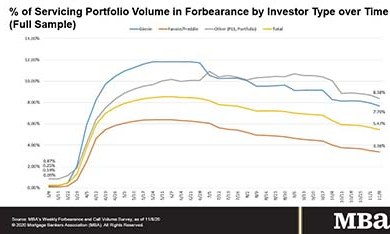

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

Better disclosures would allow rating agencies to better assess commercial real estate credit risk in bank loan portfolios, said DBRS Morningstar, Toronto.

According to the latest edition of MBA's Weekly Forbearance and Call Volume Survey, the share of loans in forbearance dropped to 5.67 percent of servicers’ portfolio volume as of November 1 -- well below its peak of 8.55 percent as of June 7.

On Friday HUD released its annual report detailing the financial condition of the FHA Mutual Mortgage Insurance Fund. On Tuesday and Thursday, federal prudential regulators from the Federal Reserve, FDIC, OCC and NCUA appeared before the Senate Banking Committee and the House Financial Services Committee to discuss the economic impact of the COVID-19 pandemic.

Seth Appleton joins MISMO in December as its new President, responsible for the mortgage industry standard organization’s overall strategy and direction. He recently sat down (virtually, of course) with MBA NewsLink to discuss the future of mortgage technology/digital transformation and his vision for MISMO.

MBA Education presents Mortgage Market Developments and Becoming a Public Company, a webinar on Monday, Dec. 14 from 2:00-3:00 p.m. ET.

The MBA Mortgage Action Alliance Post-Election Update, taking place Thursday, Nov. 19 from 2:00-3:00 p.m. ET, provides MAA members (and prospective MAA members) with a briefing on election results to date and the anticipated impacts on the industry.

Dwight Capital, New York, financed $129.7 million for multifamily properties in three states.

This major trend continues – banks and lenders sticking to their core competencies and seeking strategic vendor partners for the non-core – via technology and outsourcing. The low rate ‘feeding frenzy’ will come to an abrupt end, we just don’t know when. Still yet, we are starting to see financial institutions give more focus to the bottom line – cost cutting. Engaging third-party vendors is often a first consideration, reducing fixed costs.

Fannie Mae, Washington, D.C., announced Sheila C. Bair will succeed Jonathan Plutzik as Chair of Fannie Mae’s Board of Directors, effective November 20. The Board unanimously passed a resolution appointing her Chair on October 28. Plutzik will remain on the Board of Directors.

The Federal Housing Finance Agency released its annual Performance and Accountability Report, which details FHFA's activities as regulator of the Federal Home Loan Bank System and as regulator and conservator of Fannie Mae and Freddie Mac during fiscal year 2020.

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.