Housing Starts Continue to Ramp Up

The October housing starts report from HUD and the Census Bureau shows home builders continue to respond to consumers’ seemingly insatiable demand for new housing.

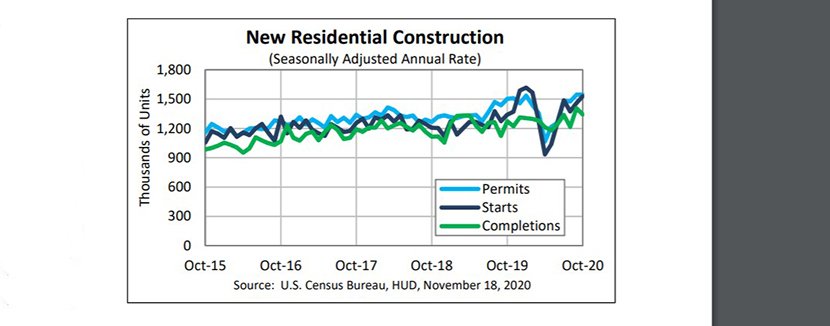

The report said privately owned housing starts in October rose to a seasonally adjusted annual rate of 1,530,000, up by 4.9 percent from the revised September estimate (1,459,000) and 14.2 percent higher than a year ago (1,340,000), the best numbers since February.

Single-family housing starts in October jumped to 1,179,000; 6.4 percent higher than the revised September figure (1,108,000). The October rate for units in buildings with five units or more fell to 334,000, down by 3.2 percent from September and down by nearly 20 percent from a year ago.

Regionally, the Northeast was the only dark spot, with starts falling by 38.6 percent in October to 78,000 units, seasonally annually adjusted, from 127,000 units in September; from a year ago, starts in the Northeast fell by nearly 33 percent.

In the South, starts rose by nearly 13 percent in October to 859,000 units, seasonally annually adjusted, from 761,000 units in September and improved by 24.3 percent from a year ago. In the West, starts rose by 4.2 percent to 374,000 units in October from 359,000 units in September and improved by 5.4 percent from a year ago. In the Midwest, starts rose by 3.3 percent in October to 219,000 units from 212,000 units in September and jumped by 23 percent from a year ago.

, analysis of this morning’s U.S. Census Bureau report on residential construction in October:

“The rise in construction is in line with other data on home builder confidence, and should help to alleviate the supply and demand imbalances seen in most parts of the country,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting with the Mortgage Bankers Association. “MBA’s recently published November forecast includes a strong pace of single-family starts next year, which should provide sufficient inventory to support a faster pace of home sales, albeit still with solid home-price growth. Combined, these trends will lead to a record year of purchase originations in 2021.”

Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said housing starts continue to top expectations.

“All of the strength in starts has come from single-family homes, reflecting the ongoing quest for space,” Vitner said. “October marks the sixth consecutive increase for single-family starts, which are now at their highest level since April 2007. The surge in single-family starts this fall coincides with record high builder confidence, reflecting exceptionally strong sales and extraordinarily low inventories.”

Vitner noted suburbs continue to perform strongly and the move to suburban markets is not limited to single-family homes. “Data on asking rents suggests there has been a clear shift in renter preferences away from urban/lifestyle apartments for suburban apartments that offer more outdoor amenities,” he said. “The bulk of apartment construction this past decade has been urban/lifestyle apartments and rents are falling in most major markets that had seen a boom in high-rise development this past decade. Development is now pivoting toward the suburbs, but overall starts have still pulled back in a major way since the start of the year.”

Vitner added apartment demand is expected to “ramp back up once the pandemic is comfortably behind us.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said new home construction appears to be healthy despite industry and economic headwinds

“The current housing market is characterized by robust demand, but not enough homes for sale,” Kushi said. “Despite the economic headwinds from the pandemic, demographic demand from millennials forming households, low mortgage rates and existing homeowners taking their equity and putting it into purchasing something bigger and better are boosting demand for homes.”

Kushi said the construction industry faces several supply-side headwinds: increasing material costs (specifically rising lumber costs), a chronic lack of construction workers, a dearth of buildable lots and restrictive regulatory requirements in many markets. “There are signs that this situation may improve in the months to come,” she said.

The report said privately owned housing units authorized by building permits in October were unchanged in October at a seasonally adjusted annual rate of 1,545,000 from September but 2.8 higher than a year ago (1,503,000). Single-family authorizations in October rose to 1,120,000; 0.6 percent higher than the revised September figure of 1,113,000. Authorizations of units in buildings with five units or more fell to 365,000 in October, down by nearly 6 percent from September (388,000) and down by 30.6 percent from a year ago.

HUD/Census said privately owned housing completions in fell to a seasonally adjusted annual rate of 1,343,000, 4.5 percent below the revised September estimate of 1,406,000, but 5.4 percent higher than a year ago (1,274,000). Single-family housing completions in October fell to 883,000, 3.4 percent below September (914,000). The October rate for units in buildings with five units or more fell to 444,000, down by 7.3 percent from September (479,000) but up by 27.6 percent from a year ago.