BREAKING NEWS

MBA Builder Applications Survey Posts Strong October, Yearly Gains

The Mortgage Bankers Association reported October mortgage applications for new home purchases increased by 5 percent from September and by nearly 33 percent from a year ago.

The Federal Housing Finance Agency yesterday released a final rule that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac.

The October housing starts report from HUD and the Census Bureau shows home builders continue to respond to consumers’ seemingly insatiable demand for new housing.

RE/MAX, Denver, said for the first time since 2009, homes sold faster in October than the preceding summer peak season.

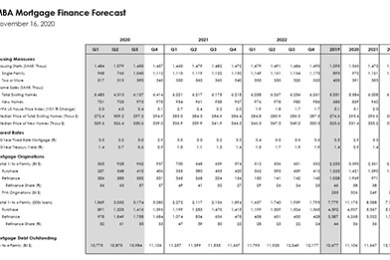

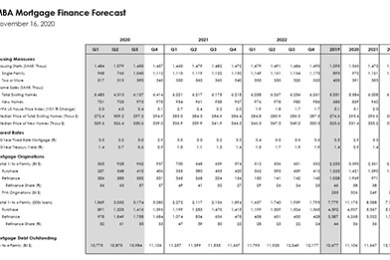

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

The MBA Mortgage Action Alliance Post-Election Update, taking place Thursday, Nov. 19 from 2:00-3:00 p.m. ET, provides MAA members (and prospective MAA members) with a briefing on election results to date and the anticipated impacts on the industry.

More young adults are returning to the rental market reported Zillow, Seattle.

The Mortgage Bankers Association's annual State of the Association takes place Wednesday, Dec. 2 from 3:00-4:00 p.m. ET.

MISMO®, the mortgage industry standards organization, announced a call for participants for a new workgroup focused on a standards solution for commercial real estate.

Seth Appleton joins MISMO in December as its new President, responsible for the mortgage industry standard organization’s overall strategy and direction. He recently sat down (virtually, of course) with MBA NewsLink to discuss the future of mortgage technology/digital transformation and his vision for MISMO.

Marcus & Millichap, Calabasas, Calif., sold six Walgreens drugstores and a Publix grocery store in six states.

This major trend continues – banks and lenders sticking to their core competencies and seeking strategic vendor partners for the non-core – via technology and outsourcing. The low rate ‘feeding frenzy’ will come to an abrupt end, we just don’t know when. Still yet, we are starting to see financial institutions give more focus to the bottom line – cost cutting. Engaging third-party vendors is often a first consideration, reducing fixed costs.

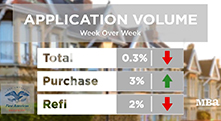

Mortgage applications fell slightly even as key interest rates remained below 3 percent, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending November 13.