MBA Advocacy Update Nov. 2, 2020

On Wednesday, HUD extended FHA’s appraisal and reverification of employment flexibilities through December 31. On Tuesday, MBA submitted comments in response to the proposed interagency flood insurance Q&A jointly issued by the OCC, the Federal Reserve, FDIC, NCUA and FCA. Also on Tuesday, MBA issued a call to action to MAA members in Pennsylvania urging Gov. Tom Wolf to approve legislation (HB 2370) that would permanently enable the use of RON in the state.

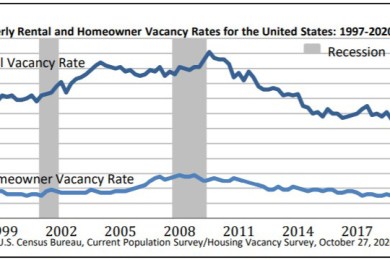

3Q Homeownership Rate Falls by 0.5%

Despite a jump in home purchase activity this summer—but also perhaps because of the coronavirus pandemic—the U.S. homeownership rate slipped by 0.5 percent in the third quarter, the Census Bureau reported Thursday.

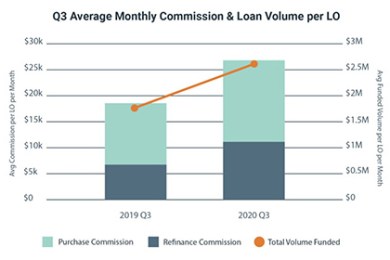

LBA Ware: Heavy Loan Volumes Keeps LO Compensation Elevated

LBA Ware, Macon, Ga., releases its third quarter Mortgage Loan Originator Compensation Reports, showing commissions earned by LOs increased by 50% from a year ago, because the average LO funded 51% more volume in the third quarter ($2.6 million per month) than a year ago ($1.7 million per month).

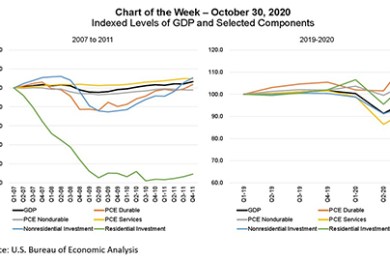

MBA Chart of the Week: Indexed Levels of GDP

This week’s chart compares the 2008-2010 Great Recession (left), to the recent pandemic-driven recession (right), to illustrate the differences in consumer spending and in both nonresidential and residential investment.