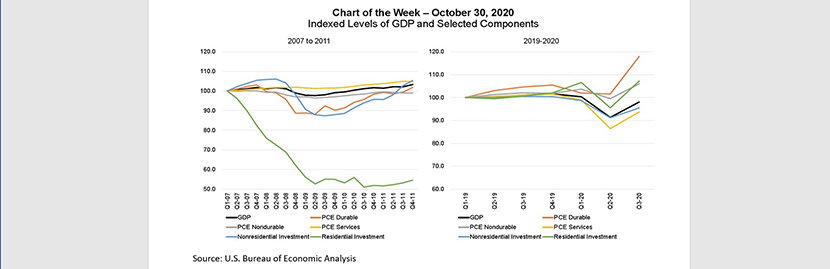

MBA Chart of the Week: Indexed Levels of GDP

Economic growth rebounded 33.1 percent in the third quarter of 2020, with multiple segments of the economy – after a sharp 31.4% plunge in the second quarter – showing strong growth. Expressed as an annual rate, consumer spending on durable goods was up more than 80%, business spending on equipment increased more than 70%, residential investment increased almost 60%, and both exports and imports of goods were up over 100%. The data show a picture of an economy re-opening and restocking over the summer.

This week’s chart compares the 2008-2010 Great Recession (left), to the recent pandemic-driven recession (right), to illustrate the differences in consumer spending and in both nonresidential and residential investment. Even with a 33% increase in GDP in this year’s third quarter, the level of GDP has not returned to where it was in the first quarter. Nonresidential investment was still around 3% lower in the third quarter, while consumer spending on services was 5% lower. This points to the significant negative hit to sectors that rely heavily on in-person activity such as leisure and hospitality. During the Great Recession, spending on services remained strong.

On the other end of the spectrum are consumer spending on durable and nondurable goods, which were both higher in the third quarter compared to the first quarter. Many households are spending more time at home and have spent on goods in connection with this change in lifestyle. Think: appliances, home office supplies and groceries.

Finally, as shown in the chart on the left, the residential investment component of GDP did not return to pre-recession levels in the last episode, but after a brief downturn in this year’s second quarter, it has bounced back – in line with the jump in housing demand, driven by delayed activity from the spring and demographic factors. Furthermore, many households are seeking to move to less dense areas, or into homes with layouts to accommodate remote-work and distance-learning arrangements.

The third quarter 2020 rebound in growth is consistent with the gains we have seen in the job market. MBA expects that the pace of economic growth will slow in the fourth quarter and into next year, but expansion should nonetheless continue, provided the current spike in virus cases does not lead to another complete lockdown.

–Mike Fratantoni mfratantoni@mba.org; Joel Kan jkan@mba.org.