California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.

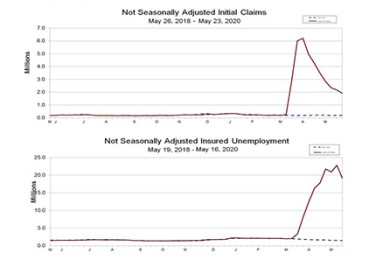

New Initial Claims at 2.1 Million; Total Claims Top 40 Million

American workers filed an additional 2.1 million initial claims last week, bringing the 10-week total for claims to nearly 41 million, the Labor Department reported yesterday.

April Pending Home Sales Plunge Nearly 22%

Pending home sales fell sharply in April, marking two straight months of steep declines amid the coronavirus pandemic, the National Association of Realtors reported yesterday. Every major region experienced a drop in month-over-month contract activity and a decline in year-over-year pending home sales transactions.

FHFA Announces New Fannie Mae, Freddie Mac LIBOR Transition Resources

The Federal Housing Finance Agency yesterday announced Fannie Mae and Freddie Mac launched new websites that provide resources for lenders and investors as they transition away from the London Interbank Offered Rate.