ANNOUNCEMENT

MBA offices will be closed this Monday, May 25 in observance of the Memorial Day holiday. On behalf of MBA officers and staff, have a safe, healthy and happy holiday.

Existing home sales plunged in April, the National Association of Realtors reported yesterday, continuing a two-month skid in sales brought on by the coronavirus pandemic to the lowest level in nearly 10 years.

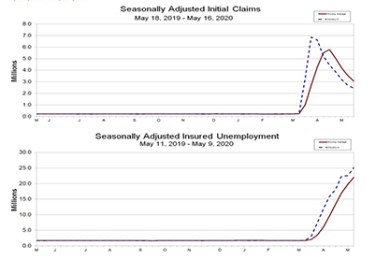

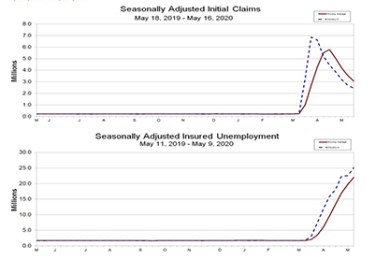

Another 2.4 million Americans filed initial jobless claims last week, the Labor Department reported yesterday, bringing to 38.6 million workers who have applied for unemployment assistance since the coronavirus pandemic clobbered the U.S. economy nine weeks ago.

The Mortgage Action Alliance, the grassroots advocacy arm of the Mortgage Bankers Association, issued a “Call to Action” yesterday urging its members to contact their House representative in support of legislation that would promote consumer access to credit during the coronavirus pandemic.

The Federal Housing Finance Agency issued a notice of proposed rulemaking that establishes a new regulatory capital framework for Fannie Mae and Freddie Mac. The proposed rule is a re-proposal of the notice of proposed rulemaking published in July 2018.

The COVID-19 crisis has shocked markets everywhere, but some U.S. real estate economists expect a short-lived recession and above-average GDP growth in 2021 and 2022, said the Urban Land Institute, Washington, D.C.

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard hitting the coronavirus pandemic has been on homeowners.

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

Amid COVID-19 and these rapidly changing market conditions in the mortgage industry, communication and engagement with your current borrowers and prospective borrowers are vital. The need to educate and inform is more critical now than ever before.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Creating frictionless experiences is imperative to customer-facing businesses, and reducing friction is now a core driver of competitive differentiation. Lending organizations are continuously thinking about how to attract and retain customers by offering consistently relevant, personalized, and frictionless experiences while taking nothing for granted.

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. The theme for today’s article is a unique set of circumstances that is enlisting homeowners to be an active participant within the appraisal process during the pandemic – and likely into the future.

Marcus & Millichap, Calabasas, Calif., closed two transactions in California totaling $48.9 million.