CFPB Issues Notices of Rulemaking to Address GSE ‘Patch’

The Consumer Financial Protection Bureau Monday issued two Notices of Proposed Rulemaking to address the impending expiration of the Government-Sponsored Enterprises Patch, also known as the GSE Patch, which affects nearly one million mortgage loans.

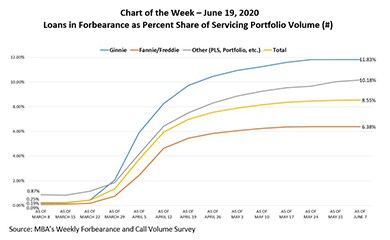

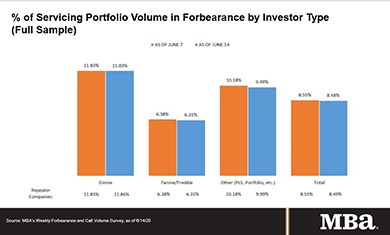

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

FHA Issues Temporary Waiver Suspending Early Payment Default Reviews

The Federal Housing Administration yesterday issued a temporary waiver of its Single Family Housing Policy Handbook4000.1 to temporarily suspend the requirement that mortgagees select and review all Early Payment Defaults on a monthly basis.

MBA Advocacy Update

Last week, Federal Reserve Chairman Jerome Powell appeared before both the Senate Banking and House Financial Services Committees to give his semi-annual monetary report to Congress. Last Thursday, California Assembly Bill 2501, which would have enacted sweeping new forbearance standards beyond federal CARES Act mandates for residential and multifamily mortgages, was not approved ahead of a critical procedural deadline – a big win for the industry.

May Existing Home Sales Down Nearly 10%–But Analysts See Upside

Existing home sales fell by nearly 10 percent in May from April—the third consecutive monthly decline in the wake of the coronavirus outbreak—the National Association of Realtors reported yesterday. But analysts saw positive signals despite the drop, as first-time buyer and Millennial demand showed signs of intensifying.