Jay Coomes: Advance Your Efficiency

Jay Coomes is Director of Product Strategy Management in Financial & Risk Management Solutions with Fiserv, Brookfield, Wis.

Hungry? Don’t worry. You can get through most drive-through lanes in a few minutes. Need something in two days or less? Shop Amazon.com.

How do those companies do it? Across industries, the most efficient players have tightened and perfectly coordinated their internal operations. They’ve deconstructed their processes into microsegments, some taking mere seconds to complete, and connected them into seamless workflows.

Smoother internal processes can lead to happier consumers, increased profitability and reduced costs. Domino’s set the bar for 30-minute pizza delivery, and Henry Ford turned his hanging conveyor belt into cheaper, more accessible cars for the masses. And McDonald’s paved the way for faster food service by revamping the way hamburgers are assembled.

Somewhere in your internal processes, you also have efficiencies to gain.

Find the Gaps

Every department, from lending to HR, has a core application. Within each department, workflows automate and accelerate the most common processes. Unfortunately, departmental applications don’t always work neatly across operational processes. When one system doesn’t talk to the next, manual tasks – spreadsheets, databases, scanning and rekeying – are used to connect siloed workflows. That creates barriers to efficiency.

Consumers can feel your processes breaking down. Maybe an employee has to check a half-dozen systems or sort through 20 forms before responding, make multiple requests for the same information or re-enter data at every step. Those speed bumps slow down important processes and diminish the consumer experience.

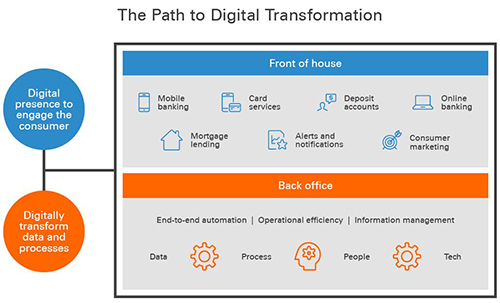

Internal processes and operations need to work together seamlessly to deliver optimal consumer experiences. Connecting people, tasks and information across the enterprise results in faster, more consistent responses and, ultimately, an enhanced consumer experience.

Here are four truths for financial institutions pursuing efficiency:

1. Workflows Are Just the Beginning

The key to operational efficiency is to connect the entire enterprise. Workflows are necessary, but not an end goal.

Let’s go back to the fast food drive-through window. Your fry machine can’t be slower than the burger station. And where’s your bagger? Each step in the process can meet individual efficiency goals and still not deliver a full meal. Similarly, departmental workflows are helpful in the short term, but too isolated to create experience-changing efficiencies.

Work to minimize the number of gaps between systems. Everyone on your team should have access to accurate data when they need it. Think fewer hand offs and more first-call resolutions.

Financial institutions can leverage data and process digitization across the entire organization – not just individual departments – to improve profitability and the consumer experience.

2. Change Is Constant

As a best practice, operational processes should be constantly changing to meet new needs. Don’t implement automated workflows and let them sit, unaltered, for years.

Every targeted consumer segment will have changes in their situations, locations or goals. When that happens, critically evaluate whether your organization is set up to continue serving those consumers. If not, react quickly.

Workflows should be agile and adaptable to match demographic shifts, market trends and product innovations. Competitive financial institutions offer and integrate the tools consumers want – even as those needs and wants change. Look for more efficient ways to scale your processes across the entire operation. Deploy the technologies that meet consumers’ needs as they evolve.

3. Measure What Matters

You can’t improve what you don’t measure. Financial institutions process all kinds of data all day, every day. But can multiple people and systems access it? Add to it? Talk to it?

Measurement of data is another area where departmental workflows typically fall short. While workflows are effective at autopiloting small tasks, they don’t collect or display the enterprise-wide data leaders need to measure and improve processes.

Key data inputs should be accessible and actionable, which requires creating end-to-end connections between your data, people and processes. Only then can measurements and audits support ongoing process improvements.

4. Happiness Is Contagious

Consumers aren’t the only ones who appreciate a well-oiled machine; employees also benefit when redundant and manual processes are removed.

As an example, some financial institutions still rely on original paper documents, manual file transport, printing, scanning and indexing. In those instances, responding to a single loan inquiry or a servicing question can take hours to complete. That’s painful for everyone.

Manual workarounds and duplicate systems add more than just overhead. They slow down processes and detract from employees’ productivity and satisfaction. With streamlined enterprise-wide processes, your workforce can gain back valuable time – and spend it delivering an excellent consumer experience.

Pursuing True Efficiency

Most departmental applications aren’t set up for organization-wide efficiency. But when they’re connected across the enterprise, they can operate effectively and with visibility.

Look closely at what’s happening inside your organization to understand how operational processes are affecting key performance measures. Productivity, cost, risk and the consumer experience are all influenced by your back-office processes. When you successfully transform your internal processes, you not only save time and money, improve profitability and satisfy customers, you can also more successfully pursue your strategic goals.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)