Note to Readers

The next MBA Advocacy Update will publish Monday, Jan. 13

Last week, we brought you a story about which U.S. housing markets changed the most over the past decade. Today, we present predictions for 2020’s hottest housing markets, courtesy of Zillow, Seattle.

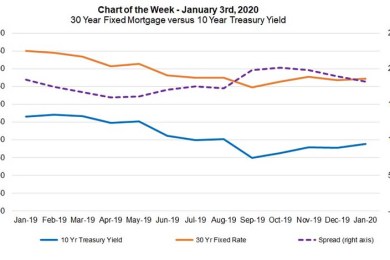

This week’s chart shows the narrowing of the spread between the 30-year fixed mortgage rate and the 10-year Treasury yield--from a high of 208 basis points in September to 183 basis points at the end of December.

![]()

First American Financial Corp., Santa Ana, Calif., acquired Title Security Agency LLC, a brand within the Arizona real estate community. First American had been a minority owner for five years.

The Mortgage Bankers Association and MBA NewsLink are accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. Nominations will be accepted through Friday, Jan. 10.

The House and Senate are back in town, but don’t expect a lot of activity—yet. Committees—particularly the Senate Banking Committee and House Financial Services Committee—will take their time gearing up for activity this year.

Ginnie Mae and the VA began drafting new lender regulations last year that would require lenders to educate veterans with more information, allowing for better decision-making in deciding on the benefit of the cost of an Interest Rate Reduction Refinancing Loan.

Natural disasters have become seemingly commonplace, as every season seems to bring a major storm, flood, hurricane or wildfire somewhere in the country. These events obviously have devastating impacts on homeowners. But on one level or another, they have also revealed weaknesses among mortgage servicers and their ability to respond appropriately.

OptifiNow, Seal Beach, Calif., hired Linn Cook as Vice President of Sales, responsible for leading sales of its cloud-based sales and marketing platform.

Lincoln Property Co., Dallas, and partner Cadillac Fairview closed a U.S. multifamily fund.

In this ongoing article series, we report on mortgage and credit union vendor marketplace events and trends, and we then share our viewpoints. Today we focus on a subset of vendors whereby each have an intriguing model adding value to clients – and substantially serving borrowers too. Technology is blurring the lines, enabling innovation and expansion of traditional business boundaries.