MBA: 4Q Mortgage Delinquencies Fall to 40-Year Low

Mortgage delinquency rates for loans on one-to-four-unit residential properties in the fourth quarter fell to the lowest level since the Mortgage Bankers Association began tracking such data.

The MBA National Delinquency Survey reported the delinquency rate for one-to-four unit residential properties in the fourth quarter fell to a seasonally adjusted rate of 3.77 percent of all loans outstanding, down by 20 basis points from the third quarter and by 29 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter remained unchanged at 0.21 percent.

“The mortgage delinquency rate in the final three months of 2019 fell to its lowest level since the current survey series began in 1979,” said Marina Walsh, MBA Vice President of Industry Analysis. “Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment at historic lows, it’s no surprise to see so many households paying their mortgage on time.”

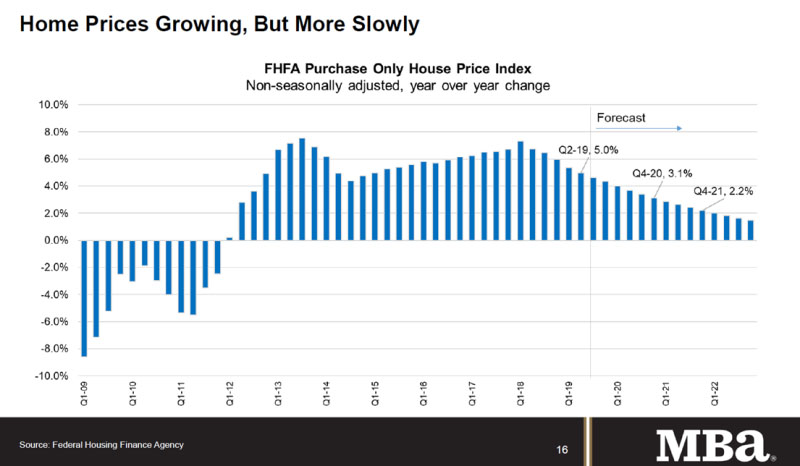

Walsh noted signs of healthy conditions were seen in other parts of the survey. The foreclosure inventory rate–the percentage of loans in the foreclosure process—fell to its lowest level since 1985. Even states with lengthier judicial processes continued to chip away at their foreclosure inventories, “and it also appears that with home-price appreciation and equity accumulation, distressed borrowers have had alternative options to foreclosure,” she said.

Other key findings of the MBA Fourth Quarter National Delinquency Survey:

–From the third quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 3 basis points to 2.17 percent; the 60-day delinquency rate decreased 5 basis points to 0.70 percent; and the 90-day delinquency bucket decreased 12 basis points to 0.90 percent.

–By loan type, the total delinquency rate for conventional loans decreased by 18 basis points to 2.82 percent over the previous quarter. The FHA delinquency rate increased by 16 basis points to 8.38 percent; and the VA delinquency rate decreased by 29 basis points to 3.64 percent over the previous quarter.

–On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 37 basis points for conventional loans; by 27 basis points for FHA loans; and by 7 basis points for VA loans from the previous year.

–The delinquency rate includes loans at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.78 percent, down 6 basis points from the third quarter and 17 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the third quarter of 1985.

–The seriously delinquent rate (the percentage of loans 90 days or more past due or in the process of foreclosure) fell to 1.76 percent, a decrease of 5 basis points from the third quarter and a decrease of 30 basis points from a year ago. This is the lowest rate since third quarter 2000. The seriously delinquent rate decreased by 9 basis points for conventional loans, increased by 8 basis points for FHA loans and increased by 5 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 34 basis points for conventional loans, decreased by 29 basis points for FHA loans and decreased by 4 basis points for VA loans.

States with the largest decreases in their foreclosure inventory rate over the previous quarter include New York (27 basis points); Maine (27 bps); Hawaii (17 bps); New Jersey (15 bps); New Mexico (14 bps); and Vermont (14 bps). All of these states except Hawaii have judicial foreclosure processes; Hawaii has both judicial and non-judicial processes.