BREAKING NEWS

MBA: Loans in Forbearance Show Little Movement for 3rd Straight Week

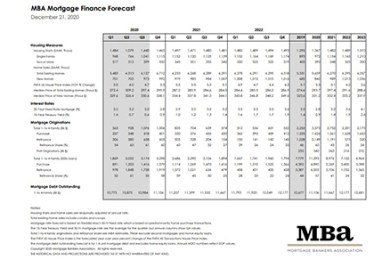

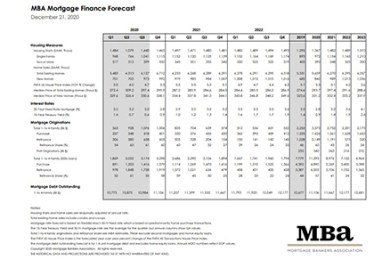

Following one of the most volatile years in memory, the Mortgage Bankers Association's latest Mortgage Finance and Economic Forecasts seem decidedly normal.

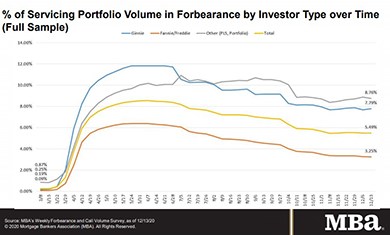

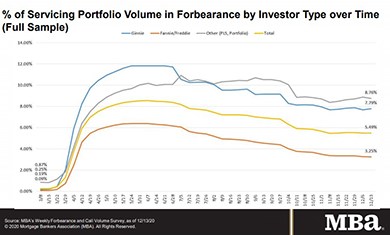

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

![]()

Fitch Ratings, New York, said commercial mortgage-backed securities borrowers are taking advantage of the current low interest rate environment to defease their loans.

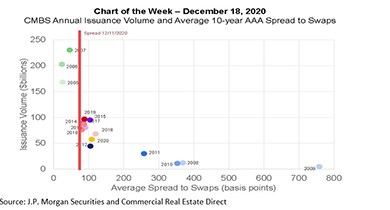

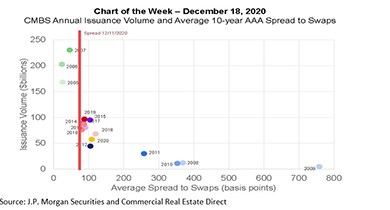

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

The Mortgage Bankers Association hired mortgage industry veteran Charmaine Brown to fill its newly created position of Director of Diversity and Inclusion. Brown, who will start on Jan. 4, will be responsible for developing, promoting and advancing diversity and inclusion programs for the real estate finance industry.

2020 is ending…and 2021 is coming into view. A few thoughts that should be dancing around in your head…along with those sugar plums.

Chetan Patel is COO of Verity Global Solutions, San Antonio, Texas, a provider of highly crafted services spanning the mortgage loan lifecycle. He has more than 25 years of leadership experience in the mortgage industry and has been recognized as an IT All-Star by Mortgage Banking magazine.

Bellwether Enterprise Real Estate Capital LLC, Cleveland, closed two loans totaling $41.5 million for distribution centers in southern California and Pennsylvania.

The Mortgage Bankers Association, the American Bankers Association and the Housing Policy Council on Thursday asked federal agencies to issue guidance establishing a consistent timeframe for CARES Act forbearance under their respective programs.

The Mortgage Bankers Association announced it combined all of its signature spring conferences into a single Spring Conference & Expo, taking place via MBA LIVE from Apr. 20-22.

MBA – along with several trades – sent a letter to Treasury Secretary Steven Mnuchin expressing concerns regarding the possible release of the GSEs from conservatorship. On Wednesday, FHFA released a final rule extending the current single-family and multifamily GSE affordable housing goals by one year, through 2021.