Slight Revisions to MBA Mortgage Finance, Economic Forecasts

Following one of the most volatile years in memory, the Mortgage Bankers Association’s latest Mortgage Finance and Economic Forecasts seem decidedly normal.

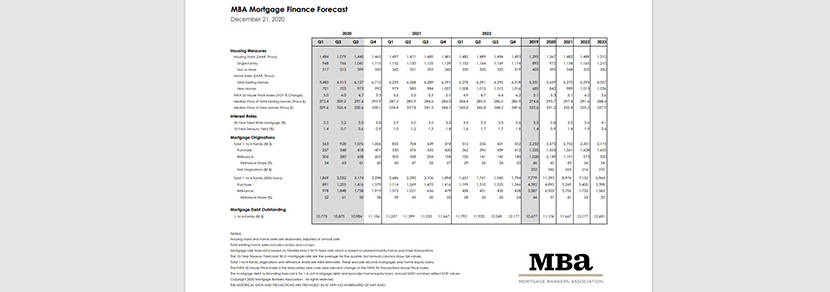

The December Mortgage Finance Forecast (https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary) sees some minor adjustments–certainly not in the dramatic fashion of recent months. MBA revised up–again–its 2020 forecast for one-to-four family mortgage originations; MBA now says originations will finish 2020 at 3.573 trillion, up from November’s 3.390 trillion. The forecast is 50 percent higher than 2019’s $2.253 trillion and is the highest forecast since 2003 ($3.381 trillion).

MBA revised up its 2020 purchase originations forecast to 1.424 trillion from 1.421 trillion in its November forecast. And it revised up its 2020 refinance originations forecast to $2.149 trillion, up from November’s $1.969 trillion.

With record-low interest rates persisting, MBA also revised upward its 2021 forecast to $2.752 trillion. MBA expects purchase originations to rise to $1.561 trillion in 2021, while refinance applications are forecast to drop as interest rates gradually rise to $1.191 trillion. Looking further ahead, MBA projects 2022 originations to fall to $2.201 trillion and 2023 originations to fall to $2.173 trillion–still elevated by historical standards and compared to recent years.

MBA forecasts record-low interest rates to rise gradually in 2021, finishing this year at 2.80 percent before rising to 3.2 percent in 2021, 3.6 percent in 2022 and 4.1 percent in 2023.

MBA sees little change in housing starts: it forecasts housing starts to finish 2020 at 1.363 million, increasing to 1.482 million in 2021, 1.489 million in 2022 and 1.510 million in 2023. Single-family starts are expected to top 1 million in 2021 (1.134 million) and grow to 1.165 million in 2022 and 1.210 million in 2023. Multifamily starts are projected to continue a downward trend, reaching 395,000 in 2020; 348,000 in 2021; 325,000 in 2022 and 300,000 in 2023.

The median price of new homes is expected to continue to rise, from $331,400 in 2020 to $339,400 in 2023.

On the economic side, MBA says real gross domestic product–which finished 2020 at -2.2 percent from a year ago–to improve to 3.5 percent in 2021 as the economy recovers from the coronavirus pandemic and more people obtain vaccines.

MBA expects the unemployment rate–which spiked as high as 14.7 percent earlier this year–to finish 2020 at 8.1 percent, settling to 5.8 percent in 2021, 4.6 percent in 2022 and 4.5 percent in 2023. MBA also expects the Federal Reserve to leave the federal funds rate alone for at least the next two years, possibly longer, until the volatile economy shows some staying power. It expects the federal funds rate to remain at 0-0.25 percent at least through 2022 and well into 2023.