BREAKING NEWS

FHFA Delays Controversial GSE Adverse Market Refi Fee to Dec. 1; Applications Down in MBA Weekly Applications Survey

The Federal Housing Finance Agency this afternoon said Fannie Mae and Freddie Mac would delay implementation of a controversial Adverse Market Refinance Fee by two months, to Dec. 1.

Mortgage applications fell for the second straight week amid little movement in interest rates, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending August 21.

Sales of new single-family houses in July posted another strong double-digit gain, jumping to their strongest pace since 2006, HUD and the Census Bureau reported yesterday.

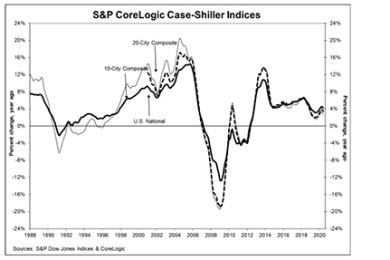

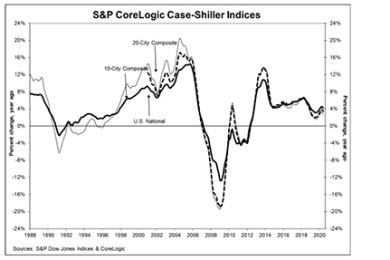

S&P Dow Jones Indices, New York, said S&P CoreLogic Case-Shiller Indices showed U.S. home prices rose by 4.3 percent annually in June, unchanged from May.

Overlooking this factor when choosing an eClosing technology service provider could cost you.

Kroll Bond Rating Agency, New York, said the COVID-19 pandemic accelerated many commercial real estate trends already in progress.

State financial service regulators launched a survey of licensed mortgage loan originators yesterday to gather information on various job functions as part of a process to validate the nationwide licensing exam.

Tauro Capital Advisors, Los Angeles, secured $50 million in revolving debt facilities for single-tenant triple-net-lease property developers.

MBA CREF Associate Director Kelly Hamill interviewed Emily Rasmussen, Managing Director of Business Strategy with Harbor Group Consulting, and George O'Neil III, Managing Director with CW Financial Services LLC, about the insurance market during the coronavirus pandemic.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

It’s that time of year again. The annual renewal invoices for your trade association memberships arrive. You think about how you leveraged memberships over the past year but it’s likely that your company could have done more to get the most out of it. Here are a few suggestions on how commercial/multifamily members can effectively leverage Mortgage Bankers Association resources to get the most benefit from your firm’s membership.

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by just 1 basis point, from 7.20% of servicers’ portfolio volume as of Aug. 16 from the prior week. MBA estimates 3.6 million homeowners are in forbearance plans.